- Moving the market

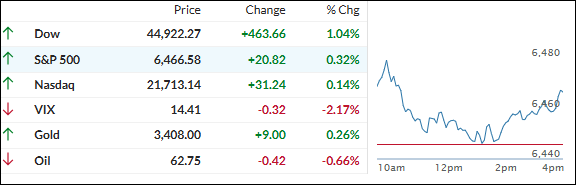

The post-CPI euphoria is still alive and well—stocks kept rallying to fresh all-time highs, led by the Dow while the Nasdaq lagged a bit behind. Tech didn’t sit out, though: AMD jumped more than 6% and Apple snuck in a 1% gain.

Today’s moves build on Tuesday’s record-setting session, which was supercharged by a cooler inflation report and sent rate-cut hopes through the roof. Traders are now basically convinced—pricing in a 99% chance—that the Fed will lower rates in September.

It’s not all about inflation, either: a surprisingly strong second-quarter earnings season is helping fuel the optimism. Earnings reports have slowed for a minute, but next week big retail names step up—so expect plenty of market buzz.

Looking ahead, tomorrow’s Producer Price Index (PPI) gives us another piece of the inflation puzzle, and all eyes are turning to the Fed’s annual Jackson Hole meeting (August 21–23) for clues on their next moves.

A big short squeeze pushed the whole market higher this afternoon, but interestingly, the Mag 7 stocks lagged most of the S&P 500.

Bond yields slipped, the dollar dropped below a key level, and gold managed just a modest gain despite all that.

Bitcoin’s on a tear again, topping $122,000—maybe finally ready to hit a new all-time high.

With so much optimism and momentum, is this rally just getting started, or will the upcoming data or Fed chatter throw another curveball at the market?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The major indexes kept climbing today, though the rally lost a bit of steam.

The Nasdaq barely budged, hovering around the flat line for most of the session, while the other indexes inched higher.

Our TTIs held onto yesterday’s strong momentum and finished the day solidly in the green.

This is how we closed 08/13/2025:

Domestic TTI: +6.21% above its M/A (prior close +4.72%)—Buy signal effective 5/20/25.

International TTI: +10.46% above its M/A (prior close +9.54%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli