ETF Tracker StatSheet

You can view the latest version here.

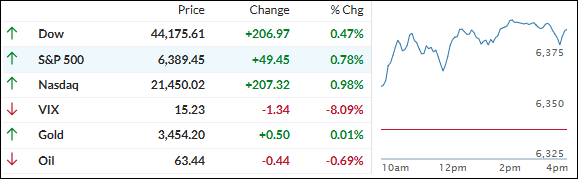

NASDAQ LEADS SYNCHRONIZED RALLY AS GOLD FUTURES HIT NEW HIGHS

- Moving the market

Stocks kicked off Friday in sync, with all the major indexes climbing together and eyeing another winning week—thanks, in large part, to the Nasdaq’s strong run.

Gold futures, already on a roll this week as traders bet on a possible Fed rate cut, blasted to record highs following a Financial Times report about a possible levy on imported gold bars.

That news also juiced gold mining stocks, sending the VanEck Gold Miners ETF (GDX) to a 52-week high, even as the spot price of gold barely budged during regular trading hours.

Overnight, President Trump’s “reciprocal” tariffs kicked in, with some of the steepest rates hitting countries like Syria (41%), Laos, and Myanmar (40%).

While the immediate impact of tariffs seems to be less turbulent, traders are still trying to figure out how ongoing trade policies could shake up corporate plans—and what it’ll mean for consumers down the line.

Meanwhile, Apple helped put some extra shine on the “Mag7” tech giants and semiconductor stocks this week since the administration exempted big names from new tariffs. The Mag7 basket surged over 5% for the week, outpacing the rest of the S&P 500 by a wide margin. The Nasdaq notched its best weekly performance since June.

Elsewhere, gold futures racked up gains in five of the past six sessions and hit fresh records, with the premium over spot prices also hitting an all-time high.

Bitcoin bounced back toward its own record highs but is still hemmed in on the charts. The dollar kept sinking even as bond yields pushed higher.

With tech leading the charge again, can this rally keep rolling, or will next week’s run of key economic reports—like CPI, PPI, and Retail Sales—throw a wrench into the works?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Stocks launched higher as soon as the opening bell rang and kept building on those gains all day, wrapping up the week in strong fashion.

The Nasdaq set the pace, leading the major indexes into the green by the close.

Our TTIs were split again: The domestic TTI edged up slightly, while the international one dipped just a bit.

This is how we closed 08/08/2025:

Domestic TTI: +3.69% above its M/A (prior close +3.52%)—Buy signal effective 5/20/25.

International TTI: +8.05% above its M/A (prior close +8.32%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli