- Moving the market

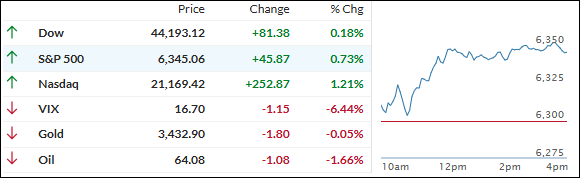

The S&P 500 started the day on a high note, as traders sifted through a new round of earnings after Wall Street’s rough patch yesterday.

Apple was the big story, jumping 3% after news broke that it’s boosting its investment in U.S. manufacturing by another $100 billion, bringing its total stateside spending to a whopping $600 billion over the next four years.

There were other bright spots, too—McDonald’s rose 2% after serving up strong second-quarter numbers and notching its fastest same-store sales growth in nearly two years.

But it wasn’t all sunshine: Snap’s stock plummeted 20% after a minor revenue miss, and Advanced Micro Devices took a 5% hit after falling shy of earnings estimates.

By the closing bell, the Nasdaq came out on top, outperforming the other major indexes, while Small Caps ended in the red. That meant the Mag 7 stocks easily eclipsed the rest of the S&P 500 for today’s session.

The rest of the market was a bit of a mixed bag: bond yields went sideways, rate-cut odds edged higher for the rest of the year, and the dollar took another hit.

Gold couldn’t catch a break and slipped just a bit. Meanwhile, Bitcoin bounced nicely back above $115,000, clawing back more than it lost yesterday—while crude oil slid to a two-month low.

ZeroHedge pointed out that the Nasdaq 100’s performance this year is eerily like its 2020 run—so the big question is: Will history repeat itself with a sharp comeback, or are we headed for a different kind of finish this time?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The S&P 500 and Nasdaq kicked off the day in positive territory, while the Dow struggled to get going.

But, by the closing bell, all three major indexes were back in the green — marking a solid rebound after yesterday’s rough selloff.

Our TTIs joined in on the bounce, though they ended the session with a bit of a split: the international TTI finished stronger, while the domestic one slipped slightly.

This is how we closed 08/06/2025:

Domestic TTI: +3.58% above its M/A (prior close +3.81%)—Buy signal effective 5/20/25.

International TTI: +7.90% above its M/A (prior close +7.14%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli