- Moving the market

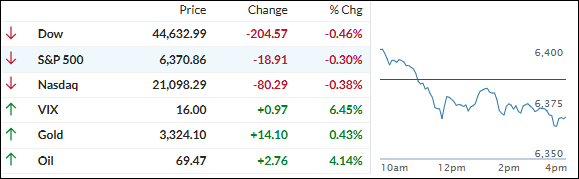

The S&P 500 started the day flat after squeezing out another record high, but excitement was nowhere to be found and trading stayed muted. By the closing bell, all the major indexes had slipped into the red, as the market couldn’t muster much momentum.

It’s a huge week for earnings, with the “Magnificent Seven” tech giants—Meta, Microsoft, Apple, and Amazon—set to report over the next couple of days. So far, 170 of the S&P 500 have shared their results, and more than 83% have beaten expectations, which has kept optimism alive even as the market treads cautiously.

Traders sorted through a scattershot of earnings on Tuesday. Boeing stock dipped, even after posting its strongest airplane deliveries since 2018, while Procter & Gamble managed a small climb thanks to a solid forecast and news of a new CEO from within its ranks.

Meanwhile, everyone’s eyes are on the Fed, which meets Wednesday—most expect interest rates to stay unchanged, but nerves are definitely showing. There’s even more on the economic calendar, including fresh GDP numbers, private payrolls, and the big July jobs report due Friday.

Elsewhere, the most shorted stocks kept heading lower, bond yields fell (boosting hopes for future rate cuts), the dollar rose a bit more, and gold bounced off its recent lows. Bitcoin took a dip early on but clawed back some ground off the $117,000 mark.

With so many major events packed into one week, could the market’s quiet spell be the calm before the storm—or will another round of surprise moves catch traders off guard?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The S&P 500 and Nasdaq started the day in the green, but the early optimism didn’t last.

As the session went on, bearish sentiment took over and dragged all the major indexes into the red by the closing bell.

Our TTIs weren’t immune either—they followed the markets lower and ended the day down as well.

This is how we closed 07/29/2025:

Domestic TTI: +5.77% above its M/A (prior close +5.82%)—Buy signal effective 5/20/25.

International TTI: +8.75% above its M/A (prior close +8.99%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli