- Moving the market

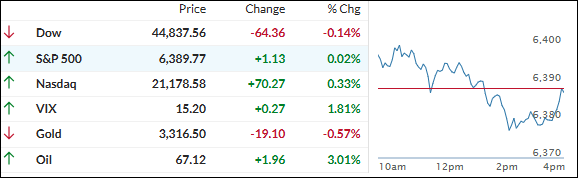

The week started on a cautious note as the Dow, S&P 500, and Nasdaq all opened in positive territory, but by the end of the session, Wall Street turned in a “nothingburger” performance.

Despite an early rebound, the Dow lost steam later and slipped back, joining the other indexes in delivering a pretty uneventful day.

Traders didn’t seem overly excited about the much-anticipated U.S.–EU trade deal, even though it marked a big shift: Trump’s headline-grabbing threat of a 35% tariff on European goods was dialed back to a more manageable 15%. That’s still a hefty jump from where we started negotiations, but it’s seen as a win in terms of calming trade tensions.

Looking ahead, there’s a packed calendar: earnings from major tech names, a key Fed meeting wrapping up Wednesday, Trump’s tariff deadline on Friday, and crucial inflation data all on deck.

More than 150 S&P 500 companies—featuring the big “Mag 7”—will be reporting, so expect a lot of focus on what they say about AI spending and whether those investments are paying off.

This week also brings GDP numbers, personal consumption (PCE) inflation data, and the all-important jobs report. With so much uncertainty in the air, traders know a breakout—higher or lower—could be just around the corner.

Elsewhere, the most shorted stocks extended their slide, bond yields were mixed, and the Fed isn’t expected to cut rates. The dollar surged thanks to the trade agreement, which pushed gold lower. Bitcoin gave up its early rally, but still found support around $118,000.

With a loaded lineup of news ahead, will the markets finally make a move—or is this holding pattern here to stay?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The day started off on a high note, with two of the three major indexes showing early strength. But that enthusiasm fizzled by midday, and those gains disappeared just as quickly.

By the closing bell, only the Nasdaq managed to finish a bit higher, while the S&P 500 ended flat, and the Dow dipped into the red.

Our TTIs also lost some ground, giving back a portion of their recent gains. Still, this pullback doesn’t change our overall positive outlook on the market.

This is how we closed 07/28/2025:

Domestic TTI: +5.82% above its M/A (prior close +6.45%)—Buy signal effective 5/20/25.

International TTI: +8.99% above its M/A (prior close +9.75%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli