- Moving the market

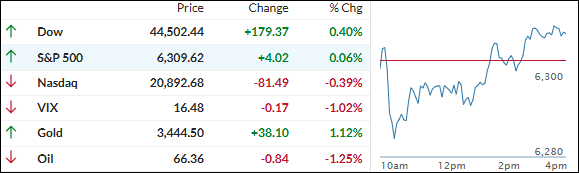

Today’s market did a complete 180 from yesterday. Early optimism fizzled fast for the tech sector, dragging the Nasdaq lower, while the Dow held strong and managed to notch a gain by the closing bell.

The main culprit? Chip stocks took a hit, with both Nvidia and Broadcom sliding by almost 3%—fallout from a Wall Street Journal report that a colossal $500 billion AI project is facing serious delays and is scaling back its ambitions for now.

Earnings painted a mixed picture. NXP Semiconductors posted results that let down investors, sending the stock 1% lower. Over in aerospace and defense, Lockheed Martin stumbled a hefty 5% after revealing big program losses and slashing its profit forecast for the year.

Tobacco giant Philip Morris also slipped, dropping 7% despite beating earnings estimates, as traders focused on missed revenue targets and forward guidance.

With so many crosscurrents, traders are now glued to management commentary about macro uncertainty, tariffs, and, of course, what’s next for AI—a theme that’s moving both markets and stock prices with every headline.

By day’s end, only the Dow stayed green. The S&P 500 flatlined, and the Nasdaq stayed down for the count.

The much-watched Mag 7 basket of mega-cap techs underperformed the other S&P 500 names, breaking its recent streak of dominance.

Bond yields drifted lower, offering some support for stocks, while the dollar continued its losing streak. Gold bucked the broader action, charging above $3,400 for a solid daily win.

Meanwhile, Bitcoin bounced around but managed to rally past $120,000 before the end of the U.S. session—keeping its curious pattern of lagging global liquidity by about three months alive.

So, with everything swirling—AI delays, chip jitters, and macro worries—will the “risk-on” mood come roaring back, or are we in for more surprises as earnings season rolls on? And for crypto watchers: Is the long-awaited $200,000 Bitcoin within reach this cycle?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The S&P 500 started the day in a bit of a slump but managed to claw its way back and finish in the green.

Meanwhile, the Nasdaq couldn’t recover, slipping into the red by the close. The Dow was the day’s steady performer—holding onto its early gains and finishing comfortably above the flat line.

Our TTIs were mostly steady, but the standout was the domestic TTI, which made an especially strong, bullish move.

This is how we closed 07/22/2025:

Domestic TTI: +5.59% above its M/A (prior close +4.26%)—Buy signal effective 5/20/25.

International TTI: +8.75% above its M/A (prior close +8.39%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli