- Moving the market

The markets kicked off the day on a high note, rallying ahead of the Fed’s interest rate decision expected later in the session.

After yesterday’s slump, investors seemed ready to shake it off—even as tensions in the Middle East remained murky. The conflict between Israel and Iran has now dragged into its sixth day, with no resolution in sight.

Despite some heated back-and-forth between Iran’s Supreme Leader Khamenei and former President Trump, traders largely brushed off the geopolitical noise and kept their eyes on the Fed. Most expected no change in rates—and that’s exactly what they got.

Fed Chair Powell held rates steady but warned that “a meaningful amount of inflation” is still expected in the coming months. That comment quickly cooled the morning’s bullish momentum, sending the major indexes back to flat by the close.

The early short squeeze fizzled, bond yields dipped, the dollar bounced around before ending slightly higher, and gold slipped but stayed within its recent range.

Oil and bitcoin both saw some intraday action but ultimately closed unchanged—though bitcoin, with rising global liquidity, might already be paving its long-term path.

Markets will be closed tomorrow for Juneteenth, and there won’t be a StatSheet this week. But stay tuned for Friday’s market commentary and Saturday’s “ETFs on the Cutline” report.

With inflation still lurking and geopolitical risks simmering, will the bulls be able to regain their footing next week?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

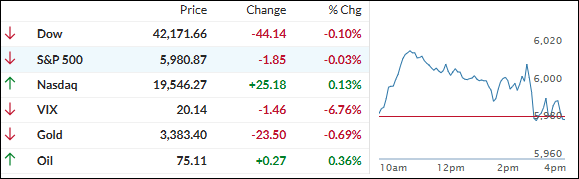

The major indexes were all over the place today—up, down, and sideways—only to end right where they started.

Early gains faded fast as ongoing tensions in the Middle East and the Fed’s decision to keep interest rates steady put a damper on investor enthusiasm.

Our TTI pretty much mirrored the broader market—some movement, but no progress by the close.

This is how we closed 06/18/2025:

Domestic TTI: +0.73% above its M/A (prior close +0.72%)—Buy signal effective 5/20/25.

International TTI: +5.95% above its M/A (prior close +5.98%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli