- Moving the market

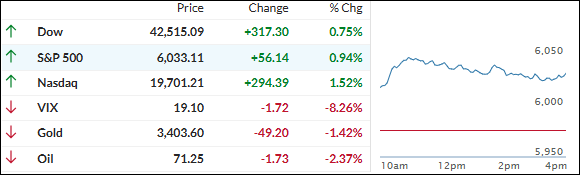

The markets kicked off the week with a strong rebound, fueled by optimism that the Israel-Iran conflict might stay contained and that Friday’s sharp sell-off may have been a bit overdone.

Traders seemed to breathe a little easier after a Wall Street Journal report suggested Iran might be open to renewed negotiations—as long as the U.S. stays out of the fight. The report also hinted that Iran had urged Israel to keep things limited. That said, Iran later denied much of it, so the picture remains murky.

Despite the ongoing conflict—now in its fourth day—Wall Street appears relatively calm, at least for now. Both countries targeted each other’s energy infrastructure today, which could have serious global consequences if things escalate, especially if the Strait of Hormuz (a vital oil shipping route) gets disrupted.

Still, the major indexes clawed back a good chunk of Friday’s losses, with the Nasdaq leading the charge. A short squeeze gave the rally an extra boost, especially for the mega-cap tech names.

In other markets, bond yields ticked up, the dollar slipped after a midday bounce, and Bitcoin surged toward the $109K mark on hopes of easing tensions.

Gold, on the other hand, gave back Friday’s gains—but if the saber-rattling picks up again, you can bet it’ll be back in demand as the go-to safe haven.

So, is this just a temporary relief rally—or the start of something more sustainable?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Wall Street bounced back a bit today, as traders and algorithms jumped back into buying mode.

The reason? There’s a growing belief that the Israel-Iran conflict might stay contained and not escalate too much in terms of duration or intensity. That bit of optimism helped recover some of the losses we saw on Friday.

On our end, the TTIs were also flashing green. They strengthened their positions relative to their trend lines.

This is how we closed 06/16/2025:

Domestic TTI: +1.69% above its M/A (prior close +0.72%)—Buy signal effective 5/20/25.

International TTI: +7.12% above its M/A (prior close +6.29%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli