- Moving the market

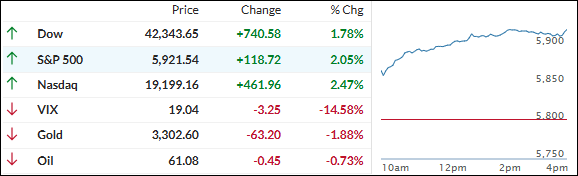

The market’s back-and-forth news action continued, but this time stocks came out on top.

Over the weekend, Trump announced he’d delay 50% of the planned tariffs on European imports until July 9th—something the head of the European Commission had requested.

That news lit a fire under futures, and the momentum carried through the regular session as traders and algorithms piled in.

Consumer confidence also got a serious lift, jumping to 98.0—well above the expected 86.0. A more relaxed tone in U.S.-China trade talks likely helped boost the mood.

Looking ahead, earnings from Nvidia, Macy’s, and Costco are on deck. So far, over 95% of S&P 500 companies have reported, with 78% beating expectations—a solid showing.

Even with falling home prices and weak Durable Goods orders, the U.S. macro data finally had a “net good” day, according to ZeroHedge—the first in five weeks. Short sellers got squeezed, giving the broader market another push.

Bond yields dipped, with the 10-year falling nearly 7 basis points to 4.5%, and the 30-year sliding below 5%.

Meanwhile, the dollar rallied alongside stocks and bonds, which took some shine off gold—though it held support at $3,300. Bitcoin, after a shaky start, bounced back and reclaimed the $110K mark.

Trade policy is still a wild card, but for now, the Conference Board’s “Uncertainty” index took a sharp dive.

Could this be a turning point—or just another blip?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Markets got a boost after Trump said he’d hold off on tariffs for European imports. That sparked a wave of optimism, and stocks rallied across the board without much hesitation.

After drifting aimlessly last week, it felt like traders and algorithms were finally ready to hit the “buy” button again.

Our Trend Tracking Indicators (TTIs) joined the party too, with the domestic one making it back into the green.

This is how we closed 05/27/2025:

Domestic TTI: +1.10% above its M/A (prior close -0.75%)—Buy signal effective 5/20/25.

International TTI: +6.31% above its M/A (prior close +5.08%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli