ETF Tracker StatSheet

You can view the latest version here.

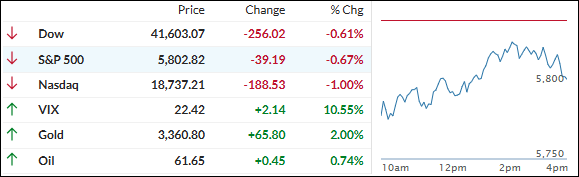

MARKETS STUMBLE AS TRADE TENSIONS FLARE—GOLD AND BITCOIN SHINE

- Moving the market

The markets stumbled out of the gate today after President Trump reignited trade tensions with a pair of aggressive tariff threats.

He proposed a 25% levy on iPhones manufactured outside the U.S.—a direct shot at Apple—and floated a sweeping 50% tariff on European Union imports starting June 1. These remarks marked his first explicit move against a specific company and rattled investor confidence.

The tech sector bore the brunt of the sell-off, with Apple sliding over 3%. Other major players like Micron, Qualcomm, and Nvidia also declined in sympathy. The timing was especially jarring, coming just as markets had begun to recover from April’s downturn on hopes of easing trade tensions.

Trump’s comments dashed those hopes, casting doubt on the durability of the recent rebound. Treasury Secretary Bessent attempted to downplay the rhetoric, but the damage to sentiment may already be done.

On a brighter note, alternative assets provided a cushion. In my advisory practice, strong allocations to gold, silver, and bitcoin helped offset equity losses and kept portfolios balanced.

Bitcoin surged to a new high before pulling back slightly, supported by robust ETF inflows. Gold had its second-best week in six months, gaining 5% and closing at a record high, buoyed by a plunging dollar.

Bond yields ended the week mixed, and oil prices slipped.

As we head into the long holiday weekend, one question looms:

Could this renewed trade aggression derail the fragile market recovery—or is it just more noise in an already volatile year?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The markets opened in the red today, pressured by renewed trade tensions as early tariff threats from former President Trump targeted both Apple and Europe.

Although there was a modest recovery from the session’s lows, it wasn’t enough to pull the major indexes back into positive territory, resulting in another down day.

Our TTIs mirrored this movement. The domestic TTI closed just below its long-term trend line for the second consecutive day. Despite this minor dip, our overall outlook remains bullish for now.

This is how we closed 05/23/2025:

Domestic TTI: -0.75% below its M/A (prior close -0.31%)—Buy signal effective 5/20/25.

International TTI: +5.08% above its M/A (prior close +5.34%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli