- Moving the market

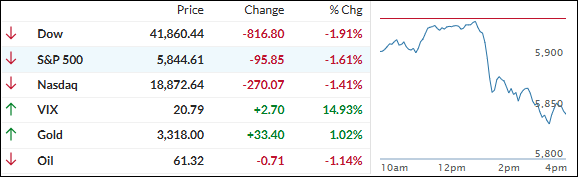

The markets opened on a weak note as rising bond yields and uncertainty surrounding the U.S. budget bill weighed on sentiment.

Traders remained focused on developments in Washington, where Republican leaders are working to finalize a bill aimed at lowering taxes while expanding deductions for state and local taxes. While potentially beneficial for taxpayers, the proposal could worsen fiscal deficits and reverse recent efforts at budgetary restraint.

Analysts expressed concern that the bill may do little to curb inflation or reduce national debt. These worries were reflected in the bond market, where yields climbed, pushing the 30-year back above the 5% mark. Confidence was further shaken by a poorly received 20-year bond auction, which reignited fears about bond market stability and drove yields even higher.

The spike in yields derailed a budding rally in equities. The major indexes reversed sharply into the close, with even the previously resilient “Magnificent Seven” stocks turning red. For the second consecutive day, retail dip buyers were notably absent—a trend highlighted by ZeroHedge.

As interest rates rose, the U.S. dollar weakened, gold reclaimed the $3,300 level, and Bitcoin surged to a new high of $109,500 before pulling back.

One analyst suggested that if Bitcoin continues to track global liquidity trends, it could reach $170,000 by August.

That’s a bold call—could he be right, or is this a case of irrational exuberance?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

An early dip in the markets was followed by a slow and steady recovery—until midday, when a disappointing 20-year bond auction abruptly halted the rebound and triggered a sharp reversal.

The major indexes turned lower and accelerated into the close, dragging down our Trend Tracking Indexes (TTIs). The domestic TTI was hit the hardest, retreating all the way back to its trend line.

For now, I’m allowing some room for movement before concluding that the recent “Buy” signal was a false alarm—a classic whipsaw. It’s possible that the entire rebound was merely a dead cat bounce within a broader bear market.

In the meantime, we’re maintaining our domestic positions, but they remain subject to our trailing sell stops for risk management.

This is how we closed 05/21/2025:

Domestic TTI: +0.01% above its M/A (prior close +2.23%)—Buy signal effective 5/20/25.

International TTI: +5.95% above its M/A (prior close +6.57%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli