- Moving the market

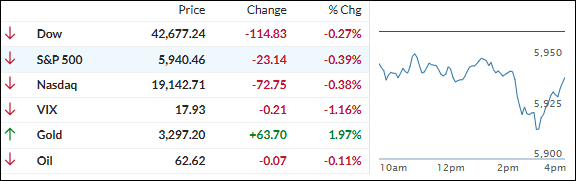

A lack of positive sentiment weighed on early trading, sending the major indexes into the red, with the tech sector leading the decline. Despite a late-session recovery attempt, the indexes remained below their opening levels, as overall market momentum appeared subdued.

The S&P 500 has staged an impressive rebound from its April lows and now sits within 3% of its all-time high set in February. Much of this rally has been fueled by optimism surrounding tariff-related developments.

However, with the 90-day tariff pause with China set to expire in August, uncertainty looms. Whether the current tone of de-escalation continues will be key to determining if the market can break into new record territory.

Meanwhile, the “Magnificent 7” stocks continued their sideways drift, mirroring the broader market’s indecision.

Bond yields edged higher, with the 30-year briefly testing the 5% mark before easing back. The dollar softened, giving gold a boost—up nearly 2%—though it stopped short of breaching the $3,300 level.

Bitcoin surged past $107,000, continuing its rally in line with expanding global liquidity.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The major indexes followed their recent trend of opening lower, but unlike previous sessions, they failed to stage a meaningful rebound by the close. As a result, all three ended the day with modest losses.

Our TTIs showed mixed performance: the international TTI posted a gain, while the domestic TTI weakened slightly, pulling back from recent levels.

This is how we closed 05/20/2025:

Domestic TTI: +2.23% above its M/A (prior close +2.50%)—Sell signal effective 4/4/25.

International TTI: +6.57% above its M/A (prior close +6.25%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli