- Moving the market

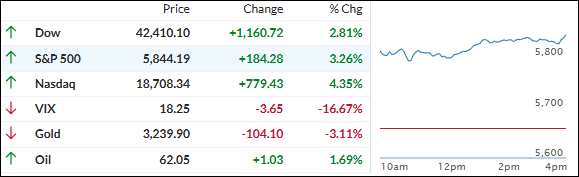

Equities surged at the opening following news that the U.S. and China agreed to temporarily slash tariffs after weekend negotiations in Switzerland.

Treasury Secretary Bessent described the talks as “very productive,” with both parties agreeing to cut reciprocal tariffs by 115% for nine days. Specifically, this means the U.S. will reduce Chinese tariffs to 30%, while China will lower tariffs on U.S. imports to 10%.

Bessent expects to meet again with the Chinese representative in the coming weeks to finalize a more comprehensive agreement.

Traders breathed a sigh of relief, and the markets responded with exuberance, pushing the S&P 500 back above its 200-day moving average (DMA) and slightly into positive territory for the year. Despite some uncertainty being alleviated, market volatility may persist until a final trade agreement is reached.

Today’s massive rally also pushed our domestic Trend Tracking Indicator (TTI) back above its trend line, though this is just the first attempt, and the sustainability of this move remains to be seen.

We saw the second-largest short squeeze of the year, as rate-cut expectations plummeted along with recession odds. Bond yields rose as traders shifted towards equities, favoring the dollar, and causing gold to drop, although the precious metal found support at the $3,200 level.

Crude oil maintained its overnight gains, while Bitcoin surged to nearly $106k overnight before retreating to $102k during the day session.

Bitcoin remains aligned with global liquidity (with a three-month lag), and some traders are now forecasting a price point above $150k by July.

Will these predictions prove accurate?

2. Current domestic “Sell” Cycle (effective 4/4/25); International “Buy” Cycle (effective 5/8/25)

Our domestic Buy cycle, which started on November 21, 2023, concluded on April 3, 2025. The market responded negatively to Trump’s tariff policy, leading to a sharp decline in major indexes and the broader market.

On April 4, 2025, our International Trend Tracking Indicator (TTI) also dropped significantly, triggering a “Sell” signal. However, it has since rebounded to a level that has generated a new “Buy” signal, effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The markets surged following the positive initial outcome of the U.S.-China tariff negotiations, opening higher and maintaining momentum throughout the day. The major indexes not only achieved solid gains but also surpassed key resistance levels.

Our TTIs mirrored this performance, with the domestic TTI breaking into bullish territory. The indicator experienced a sharp upward gap, which may close before continuing its upward trend.

At this point, I prefer to see sustained strength above this level before issuing a new “Buy” signal.

This is how we closed 05/12/2025:

Domestic TTI: +1.15% above its M/A (prior close -1.55%)—Sell signal effective 4/4/25.

International TTI: +4.70% above its M/A (prior close +3.24%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli