- Moving the market

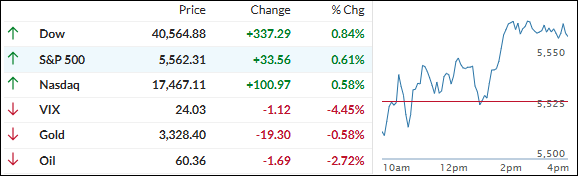

The major indexes opened flat and remained close to their initial levels in early trading, as Wall Street awaited updates on trade deal negotiations.

While the Treasury Secretary mentioned productive discussions with Japan and hinted at a potential “framework” agreement with India, the absence of details regarding China put pressure on the markets.

General Motors saw a decline despite reporting better-than-expected profits, as the automaker announced it was reassessing future guidance and suspending additional share buybacks due to uncertainties surrounding levies and rising global tensions.

Big Tech will be in the spotlight tomorrow and Thursday, with Meta, Microsoft, Apple, and Amazon set to report their quarterly results.

Of the more than 36% of S&P 500 companies that have reported so far this season, approximately 73% have exceeded expectations, according to FactSet. This is slightly below the 5-year average of 77%.

Despite market volatility, bullish sentiment emerged midday, leading to a rebound and another positive close for the major indexes. The theme of the day was “bad news is good news,” as weak macroeconomic data increased expectations for rate cuts.

Bond yields fell again, the dollar remained stable, but gold slipped while successfully defending its $3,300 level. Bitcoin edged higher, maintaining its $95k level, and continued to see significant inflows into its ETFs.

Have traders and investors recognized this chart, which seems to indicate that Bitcoin’s next major advance is imminent?

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

The first half of today’s trading session was characterized by a lack of direction, with major indexes remaining close to their opening levels. However, renewed bullish sentiment emerged around midday, driving equities to another positive close.

Our TTIs followed a similar pattern, also finishing the day higher.

This is how we closed 04/29/2025:

Domestic TTI: -3.43% below its M/A (prior close -3.99%)—Sell signal effective 4/4/25.

International TTI: +2.54% above its M/A (prior close +2.18%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli