- Moving the market

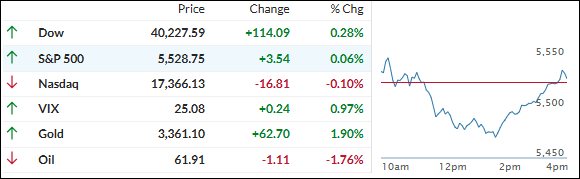

The major indexes remained relatively unchanged in early trading, ahead of this week’s announcements of big tech earnings and economic data, as well as the latest developments in the trade saga.

There is still no clarity on any potential agreement with China, although Treasury Secretary Bessent noted progress on other proposals, suggesting that a deal with India might be “one of the first” to come.

The tug-of-war continues, with Trump stating last week that discussions with China were underway, which was vehemently denied by Chinese officials.

We are now approaching the busiest period of the first-quarter earnings season, during which more than 180 S&P 500 companies will release their reports.

April has been a volatile month for the indexes. The S&P 500 briefly entered bear market territory on April 7 but has since made a recovery. However, the index has yet to break through key resistance levels, leading some technical analysts to speculate that we might reverse and test the lows again.

This is a real possibility, as markets typically experience a lot of back-and-forth and testing of resistance levels—both on the downside and the upside—before stabilizing.

Today, stocks were saved by aggressive option buying in the last hour, which pulled the S&P 500 to a green close, although the Nasdaq did not follow suit.

Most shorted stocks were squeezed, and bond yields retreated, providing further support. The dollar took a beating, which gave gold a reason to rally strongly, with the precious metal reaching $3,360 again.

Bitcoin touched $95.5k in overnight trading, swung wildly during the day session, but ultimately lost a fraction.

While the S&P 500 is still down for April, it is within striking distance of wiping out that deficit before the month ends.

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

As we anticipate a series of U.S. economic data releases this week, coupled with ongoing trade wars, market direction remains uncertain. Despite this, the Dow and S&P 500 managed to eke out small gains.

Our TTIs were aligned but outperformed the indexes.

This is how we closed 04/28/2025:

Domestic TTI: -3.99% below its M/A (prior close -4.26%)—Sell signal effective 4/4/25.

International TTI: +2.18% above its M/A (prior close +1.33%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli