- Moving the market

Futures and global markets indicated another session of losses, with the S&P 500 plunging as much as 5.5% before the selling abated and market direction suddenly reversed.

Comments from Trump, which turned out to be fake news, suggested a 90-day pause in tariffs for all countries except China, sparking bullish sentiment. However, the lack of confirmation sent prices plunging again, adding to the market chaos.

Approximately 50 nations reached out to start negotiations, with some planning retaliatory tariffs. The situation remains highly uncertain, and it appears that negotiations will be more prolonged than Wall Street traders would prefer.

This is a time of extreme uncertainty, making it difficult to determine a clear market direction. Our TTIs remain deeply in bear market territory, and it’s best to observe this turmoil from the sidelines.

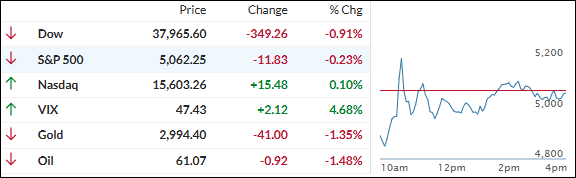

In the end, it was another wild day in the markets driven by headlines, leaving traders confused about the market’s direction. The Dow led the decline, followed by the S&P 500, while the Nasdaq managed a small gain.

Dip buying in the S&P 500 was prevalent as the index hit bear market territory, and the most shorted stocks soared 14.5% from low to high within 30 minutes, marking a dramatic squeeze.

Bond yields initially eased but then rallied, with the 10-year yield climbing back over 4%. Rate cut expectations plunged, the dollar rebounded, and gold lost its $3,000 level by a fraction.

Bitcoin experienced volatility, ending slightly lower but failing to climb back above its $89k level.

Opinions on the market’s next move are divided, with some traders seeing this as a buying opportunity while others anticipate further downside.

It’s a guessing game at this point. That’s why we’ll rely on our Trend Tracking Indexes to guide us on when to move back into equities.

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

The markets suffered significant volatility due to fake news that initially caused major disruptions in the indexes.

However, by the end of the trading day, the situation had stabilized, resulting in minimal overall changes.

Our TTIs continued to decline, further entrenching themselves in bear market territory.

This is how we closed 04/07/2025:

Domestic TTI: -10.99% below its M/A (prior close -10.24%)—Sell signal effective 4/4/25.

International TTI: -8.60% below its M/A (prior close -5.61%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli