- Moving the market

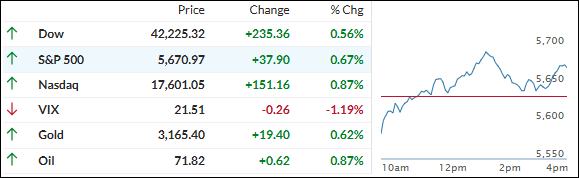

The equity markets remained steady in early trading despite a weak opening, as the dollar and major global currencies stayed within tight ranges ahead of Trump’s tariff announcement at 4 pm today.

April 2nd has been declared “Liberation Day,” with reciprocal tariffs on countries imposing duties on U.S. goods taking immediate effect after the announcement. Traders are jittery due to the uncertainty surrounding additional selective barriers.

In the last hour of trading, after some volatility, sentiment turned bullish, leading to solid gains with the Nasdaq outperforming. Some traders viewed this as a potential dead cat bounce ahead of the tariff revelations.

A positive macro data surprise index provided support, with ADP job additions surging and factory orders nearing record highs. This challenged the widespread recession narrative, as “hard data” reached its strongest level since May 2024, while “soft data” fell to its weakest since September 2024, as noted by ZH.

This shift lowered rate-cut expectations and pushed bond yields up. The dollar dipped, gold advanced modestly, and Bitcoin surged above $87k, erasing last week’s losses.

The ball is now in Trump’s court.

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The market suffered an early decline, but the major indexes quickly recovered, reaching a midday session high.

However, this peak was short-lived as the indexes slipped back into negative territory. Despite this, dip buyers stepped in, pushing the indexes to close in the green.

Our TTIs mirrored this pattern and ended the day higher.

This is how we closed 04/02/2025:

Domestic TTI: -0.22% below its M/A (prior close -1.04%)—Buy signal effective 11/21/2023.

International TTI: +3.45% above its M/A (prior close +3.20%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli