- Moving the market

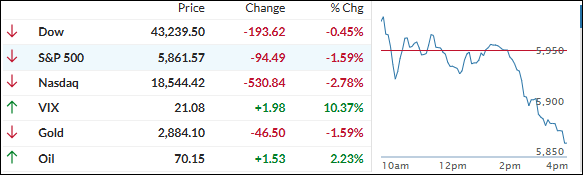

Despite Nvidia exceeding fourth-quarter estimates and providing strong AI guidance, mixed aspects of their earnings report led to an 8.5% drop in the stock. Major indexes followed suit, closing another session in the red.

Adding to the market’s woes, Trump’s announcement that tariffs on Mexico and Canada would proceed as planned, effective March 4th after a one-month moratorium, caused only the dollar to gain.

A rise in jobless claims to 242,000, higher than the estimated 225,000, further dampened market sentiment. Additionally, a collapse in Pending Home Sales to all-time lows failed to encourage dip buyers to push equities higher.

Consequently, the US Macro data index sank deeper, with the threat of “Stagflation” becoming more pronounced. The bullish case is losing momentum, with “big money” positioning to increase sell activity if crucial thresholds are broken.

Bond yields were mixed, Bitcoin initially bounced but took another hit late in the session, and gold couldn’t overcome the dollar’s strength, breaking below the $2,900 level. However, crude oil rallied sharply, regaining the $70 marker.

Both Bitcoin and the S&P 500 follow global liquidity, as shown by this chart, which highlights a divergence in dire need of correction.

Will this correction happen on the last trading day of February?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

Although the major indexes opened positively, initial optimism quickly faded as bearish sentiment took over, leading to another day of losses for equities.

Our TTIs also declined, but not as sharply as the S&P 500 and Nasdaq. Both indexes remain above their long-term trend lines for now.

However, any further declines, and a break below, could trigger a “Sell” signal, prompting us to move out of equities and into the safety of money market funds.

Stay tuned!

This is how we closed 02/27/2025:

Domestic TTI: +2.11% above its M/A (prior close +3.01%)—Buy signal effective 11/21/2023.

International TTI: +6.26% above its M/A (prior close +7.13%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli