- Moving the market

This morning, traders were still grappling with Fed Chair Powell’s hawkish comments from yesterday, indicating that he is likely to cut interest rates only twice next year, down from the four reductions forecasted in September.

The pressing question now is: what will policymakers do in 2025? If inflation worsens, as I believe it will, they may have to refrain from cutting rates altogether and possibly reverse course.

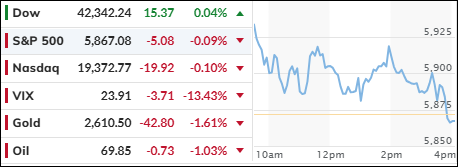

Despite this uncertainty, bullish sentiment and bargain hunters lifted the indexes out of their slump, with all three major indexes starting the session on a positive note. However, a late-day sell-off dragged the S&P 500 and Nasdaq back into the red, while the Dow managed to eke out a small gain.

The latest data releases presented a mixed picture. The final revision to Q3 GDP was strong, jobless claims were solid, and existing home sales improved. However, manufacturing continued to decline. In summary, soft data was trending downward, while hard data remained flat.

Mega Tech stocks experienced a volatile session, bond yields surged, the dollar reached two-year highs, and Bitcoin fell below the $100k mark. Gold slipped below $2,600 but rebounded to close positively.

Additionally, U.S. sovereign risk of default is rising again, as highlighted by ZH, due to the potential government shutdown tomorrow night.

Will cooler heads prevail?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

In a less dramatic fashion, the major indexes initially surged higher but soon reversed course, not only relinquishing all their gains but also incurring some modest losses.

The Dow was an exception, closing nearly unchanged.

Our TTIs suffered a similar rollercoaster ride, with the international index now nearing its long-term trend line to the downside. If this line is clearly breached, it would trigger a “Sell” signal for the international market.

This is how we closed 12/19/2024:

Domestic TTI: +1.82% above its M/A (prior close +2.16%)—Buy signal effective 11/21/2023.

International TTI: +0.30% above its M/A (prior close +1.00%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli