- Moving the market

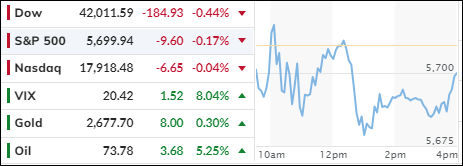

The stock market exhibited a pattern of bobbing and weaving today, as uncertainty dominated, and the major indexes fluctuated around their respective unchanged lines.

October has started on a weak note, with sentiment dampened by escalating tensions in the Middle East and the uncertain impact and duration of the East Coast port strike. Both events are expected to negatively affect the economy, but the extent of this impact remains unclear.

Growing concerns have driven oil prices up by nearly 4%, pushing them above the $73 mark to reach one-month highs. Energy equities followed suit, and even some tech heavyweights saw gains, with Nvidia rising over 3%.

Initial jobless claims continue to decline, despite a 53.4% year-over-year increase in job cut announcements. Once these job cuts translate into actual layoffs, we can expect the trend in jobless claims to reverse and head higher.

Bond yields rose due to underlying inflation data, rising oil prices, and a surprising drop in rate-cut expectations, all of which sent the dollar higher and the major indexes lower. Bitcoin found support at $60,000, while gold maintained its gains, adding 0.31% for the session.

Meanwhile, U.S. sovereign risk continued to climb, as did the Citi Economic Surprise Index, which has now reached six-month highs. This raises the question: Was the economy really in need of a 0.5% rate cut?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

Today, the markets exhibited a lack of clear direction as traders appeared hesitant to commit to either long or short positions, likely due to the anticipation of tomorrow’s significant jobs report.

This uncertainty led to a session characterized by aimless meandering, with little decisive movement.

Despite this, our TTIs suffered a slight decline, though this minor slip did not alter our overall positive outlook on the market.

This is how we closed 10/03/2024:

Domestic TTI: +7.80% above its M/A (prior close +8.31%)—Buy signal effective 11/21/2023.

International TTI: +7.06% above its M/A (prior close +7.71%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli