- Moving the market

The markets continued to build on last week’s rally, driven by the Fed’s 0.5% interest rate cut, the first in four years. Initially, the indexes fluctuated, but the S&P 500 managed a weekly gain of 1.4%, while the Dow reached a new all-time high.

However, the usual array of economic indicators remains a wildcard, potentially derailing hopes for a soft landing, particularly in the labor markets. Additionally, election risks loom large.

Fed President Goolsbee attempted to bolster market sentiment today, stating that the Fed is now able to ease monetary policy aggressively as inflation trends lower. Despite this, the Fed seems unaware that the bulk of inflationary pressures are still ahead. Goolsbee even predicted “a lot” of interest rate cuts over the next year if current economic conditions persist.

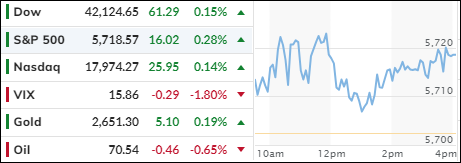

The major indexes saw modest gains, but crude oil took a hit for no apparent reason, though it held above the $70 level. Small Caps underperformed, while the Dow and S&P 500 closed at new highs.

Bond yields fluctuated and ended nearly unchanged, the dollar remained flat after an early bounce, gold climbed modestly, and Bitcoin briefly topped $64.5k before returning to its previous level.

Meanwhile, stocks and bonds continue to diverge, making me ponder how long this trend can persist.

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The major indexes continued their upward trajectory from last week, culminating in another moderately positive close.

Notably, our TTIs outshone the broader market, finishing the session on a particularly positive note.

This is how we closed 09/23/2024:

Domestic TTI: +8.05% above its M/A (prior close +7.93%)—Buy signal effective 11/21/2023.

International TTI: +7.13% above its M/A (prior close +6.83%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli