- Moving the market

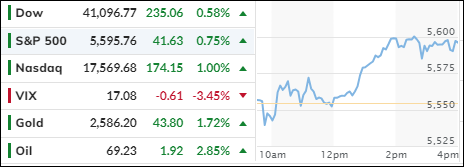

The major indexes initially opened lower but quickly rebounded, as traders ignored the latest Producer Price Index (PPI) report, which showed a 0.2% increase in wholesale prices for August, aligning with expectations.

This followed the previous day’s Consumer Price Index (CPI) report, which indicated a rise in core prices, excluding the volatile energy and food categories. While I find this exclusion impractical, it has led to speculation that the Federal Reserve is more likely to cut rates by 0.25% next week, rather than the anticipated 0.5%.

Leading the charge was the Nasdaq, buoyed by gains in mega-cap tech stocks such as Nvidia, Alphabet, and Meta Platforms, which rose by 1.9%, 2.2%, and 2.7%, respectively. Weekly jobless claims increased modestly to 230,000.

Attention also turned to the European Central Bank (ECB), which cut rates by 0.25% while predicting slower growth and higher inflation—a classic case of stagflation. This shift in September rate cut expectations impacted the dollar, which declined, while gold surged by 1.7%, reaching a new high of $2,588.

Meanwhile, the most shorted stocks experienced volatility, and the MAG7 basket continued its rebound. Bond yields edged higher but remained unchanged for the week. Oil prices also rose, and Bitcoin climbed back above the $58,000 level.

With gold and the 10-year yield diverging, traders are left wondering which will prevail in this tug of war.

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

Despite a shaky beginning, the market underwent a surge in bullish sentiment, which helped the major indexes regain stability and close the day in positive territory.

Similarly, our TTIs mirrored this trend, concluding the session on an optimistic note.

This is how we closed 09/12/2024:

Domestic TTI: +6.13% above its M/A (prior close +5.48%)—Buy signal effective 11/21/2023.

International TTI: +5.68% above its M/A (prior close +4.50%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli