- Moving the market

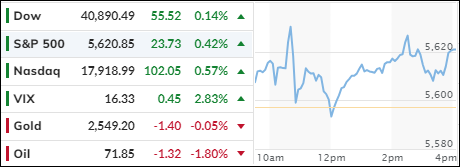

In anticipation of the minutes from the latest Federal Reserve policy meeting, traders pushed the major indexes higher, as sentiment turned bullish following yesterday’s pause.

The latest retail earnings presented a mixed picture, with Target rallying 15% while Macy’s stock dropped more than 12%.

While the Central Bank maintained its stance and left rates unchanged at the last meeting, the released minutes indicated that a decrease in borrowing costs during the September meeting was increasingly likely. Most participants agreed that “loosening monetary policy would be appropriate if data continued to come in as expected.”

As a result, the odds of a rate cut rose to 100%, and the current conversation focused on the magnitude of the potential reduction in rates. Along with today’s release of the July minutes, upcoming commentary on Friday by Fed head Powell at the Jackson Hole symposium could provide Wall Street with more clues about what’s in store.

With all eyes focused on the Fed minutes, the shocking admission by the Philadelphia Fed that US jobs were revised down by 818,000, the second worst revision in US history, was simply pushed to the back burner. Ouch!

In other words, this was another nail in the coffin of an economy that has rolled over and is in dire need of resuscitation via lower interest rates—inflation be damned.

Of course, traders and algorithms only react to current headline news, which was focused on a possible rate cut in September, and that was immediately reflected in surging rate-cut expectations.

Bond yields dropped, while Bitcoin, stocks, and gold rallied, but the dollar and crude oil tumbled. Small Caps took top billing thanks to a fresh short squeeze, but the MAG7 basket treaded water.

Unless Fed head Powell sings a different tune at the end of his symposium, lower rates now appear to be baked in the cake.

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The release of the July Federal Reserve minutes brought a sense of relief to the markets, which had experienced a midday dip. As investors digested the information, confidence was restored, leading to a rally in the major indexes by the close of trading.

Our TTIs mirrored this positive trend, ultimately achieving another favorable outcome.

This is how we closed 08/21/2024:

Domestic TTI: +6.99% above its M/A (prior close +6.24%)—Buy signal effective 11/21/2023.

International TTI: +6.99% below its M/A (prior close +6.64%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli