- Moving the market

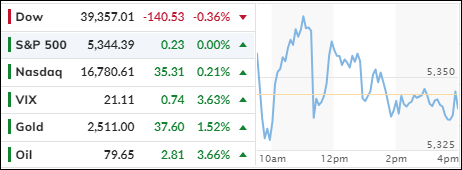

Ahead of key inflation data points, the markets fluctuated but maintained a somewhat bullish sentiment. The Dow showed the most weakness, lagging the S&P 500 and Nasdaq. Nvidia’s 2% surge helped the Nasdaq take the lead.

Wednesday’s consumer price index (CPI) report for July will be crucial. Any improvement could raise hopes that the Federal Reserve might soften its interest rate policy in their September meeting. Conversely, a worsening CPI could have a similar negative impact to the recent weak payrolls report, which sent the markets into a tailspin.

Despite the major indexes ending last week on a down note, a few rebounds minimized losses. However, concerns about an economic slowdown persist, as indicated by various metrics. This suggests that we have not seen the end of the market’s turbulent swings. Relief rallies will only be possible if economic data holds up—and that’s a big if.

The S&P 500 experienced wild swings despite stable bond yields, which slipped throughout the session. The 2-year bond found support at the 4% level. Rate-cut expectations rose for 2024 but remained flat for 2025.

Gold, on the other hand, soared towards record highs, while crude oil followed suit due to increased tensions in the Middle East. Commodities advanced along with the dollar, but Bitcoin was volatile, fluctuating between $58,000 and $60,000.

With the Producer Price Index (PPI) due tomorrow and the CPI on Wednesday, today’s calm session may come to an end if these numbers deviate from expectations.

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The S&P 500 index experienced significant volatility, fluctuating around its unchanged line throughout the trading session. Ultimately, the day concluded without any net gains or losses.

Meanwhile, our TTIs showed a slight decline. Despite this minor setback, our overall positive outlook remains unchanged.

This is how we closed 08/12/2024:

Domestic TTI: +3.24% above its M/A (prior close +3.74%)—Buy signal effective 11/21/2023.

International TTI: +2.18% below its M/A (prior close +2.26%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli