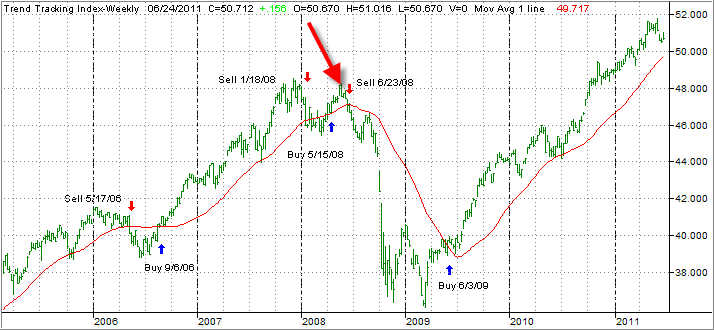

Last Thursday, June 23, 2011, marked the 3-year anniversary of the effective date of our last domestic Sell signal.

If you were a reader of this blog back then, you may recall that our Domestic TTI (Trend Tracking Index) had crossed its long-term trend line to the downside into bear market territory on 6/22/2008, thereby triggering a “Sell” the following trading day. Here’s what the moment of truth looked like:

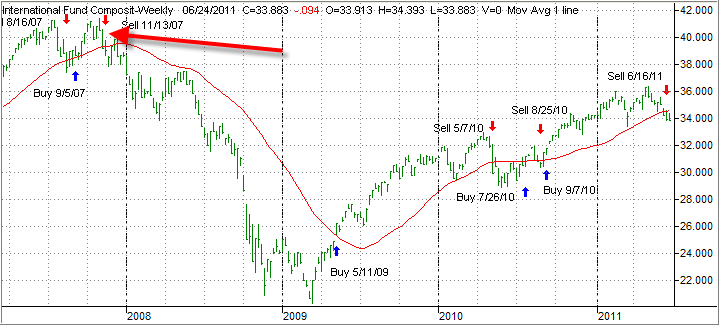

This domestic sell signal had actually been preceded by the International TTI having moved below its respective long-term trend line effective 11/13/2007, some seven months prior. Take a look at the chart of the International TTI:

The market crash of 2008 followed our exit signals and has been well documented.

Here we are three years later in a somewhat similar situation as far as market weakness is concerned. Our International TTI signaled just a ‘Sell’ effective 6/16/2011, while its domestic cousin still hovers above its own trend line by a meager +2.02%.

The fact, which staunch followers of the mindless buy-and-hold approach to investing don’t want you to know, is this: On 6/23/2008, the S&P 500 stood at the 1,318 level. Yesterday, more than 3 years later, it closed at 1,268.

In other words, all the hype about the bull market of the past 2 years has not produced any new gains; it has only helped to make up losses and has fallen short at that. Since many portfolio managers do not outperform the S&P 500, it’s safe to say that their portfolios have not yet made up the losses sustained during the crash of 2008.

While the rebound rally off the March 2009 lows was predominantly supported by trillions of various stimulus programs, we finally seem to have come to a standstill.

The month of June has inserted some reality into the market place, as the Fed’s QE-2 program is slated to come to an end this month. As stimulus has waned, the economy slowed down and has hit, what the optimists consider a “soft” patch, which seems to be hardening by the week judging by the latest economic reports.

The Fed’s number one cheerleader, Chairman Bernanke, had nothing but a somber outlook about the state of the economy during Wednesday’s press conference. This pulled the rug out from under the markets while increased downward momentum has made a potential domestic sell signal a real possibility.

Even the global landscape does not give an investor the warm fuzzies. Europe is a powder keg waiting to blow up, as the Greek debt saga continues, while a host of other well known players are waiting on deck ready for their financial spanking.

China is overheating and mired in a huge real estate bubble along with Canada and Australia. While these conditions can remain the same for a while longer, eventually some sort of reality has to set in, no matter how matter how well trained the respective politicians are in the art of kicking the can down the road.

These are uncertain times at best and, as an investor, you need to be prepared to deal with that uncertainty. The best way I know of is the use of establishing trailing sell stops on all of your positions. Please don’t use mental stops, because they don’t work.

Use end of the day closing numbers, as I do, to see if a sell stop has been triggered; if it has, wait till the next trading day and, if no huge rebound is in the making, sell your affected position.

Having a definitive plan will give not only give you peace of mind with your investments but also make it a lot easier to deal with the vagaries of the market place.

Contact Ulli