- Moving the markets

The stock market had a roller-coaster ride on Wednesday, as investors weighed the mixed signals from the latest economic data. On one hand, inflation seemed to be cooling, as labor costs fell, and productivity rose more than expected. On the other hand, the job market showed signs of slowing down, as private payrolls grew less than forecasted. These data points set the stage for the upcoming jobs report on Friday, which could have a big impact on the Fed’s policy decisions.

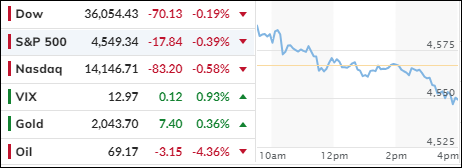

The market opened higher, boosted by lower inflation pressure and higher productivity growth. However, the rally faded as bond yields diverged, with the long-term rates dropping to their lowest level since August. The tech sector also lost steam, as the so-called “Magnificent 7” stocks gave up their early gains, while the unprofitable tech stocks continued to surge. The short-squeeze attempts failed to lift the market, and the major indexes ended the day in the red.

The dollar edged higher, along with gold, which bounced back from the 2,020-support level. Crude oil extended its losing streak to five days, as financial conditions loosened, reversing the tightening that occurred from August to October.

Fed chair Powell had previously said that the market was doing the job for him (tightening), but now that the market has undone most of that job, will the Fed have to step in and intervene?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The major stock indexes started the day strong, but lost momentum and ended lower. However, our TTIs defied the market trend and moved slightly higher, confirming their bullish positions.

This is how we closed 12/06/2023:

Domestic TTI: +3.54% above its M/A (prior close +3.50%)—Buy signal effective 11/21/2023.

International TTI: +4.15% above its M/A (prior close +3.91%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli