- Moving the markets

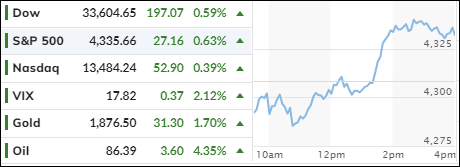

Monday was a day of surprises for the stock market, as it bounced back from a morning slump despite the escalating violence in the Middle East. The bond market took a holiday, leaving investors in the dark about the impact of the Israel-Hamas conflict on interest rates.

The major indexes started the day in the red, with the Dow dropping 154 points at its lowest point, and the S&P 500 and the Nasdaq losing 0.6% and 1.15%, respectively. But by the end of the day, they had recovered their losses and even posted some decent gains.

The market was rattled by the news that Hamas had launched a ground invasion of Israel on Saturday, catching the Israeli army off guard. The conflict could have implications for the energy market, as some analysts predicted a spike in oil prices, but others downplayed its significance. The conflict also added to the market’s anxiety about inflation and rising interest rates, which have been plaguing investors for months.

But what turned the tide for the market was a chorus of Fed officials who hinted that the Fed might be done with raising rates for now. They echoed what SF Fed President Mary Daly said on Friday, that the high 10-year Treasury yields have already done the Fed’s work of tightening financial conditions. Hmm…

If that’s true, and that’s a big if, then we might see a reversal of the recent trend in the market. Rate cuts could be back on the table, and that could boost everything from gold to stocks to crypto. But how likely is that scenario? And how long will it last?

That’s the question that traders will have to answer in the coming days. And depending on their answer, we might find ourselves back in domestic equities again—or not.

2. “Buy” Cycle (12/1/22 to 9/21/2023)

The current Domestic Buy cycle began on December 1, 2022, and concluded on September 21, 2023, at which time we liquidated our holdings in “broadly diversified domestic ETFs and mutual funds”.

Our International TTI has now dipped firmly below its long-term trend line, thereby signaling the end of its current Buy cycle effective 10/3/23.

We have kept some selected sector funds. To make informed investment decisions based on your risk tolerance, you can refer to my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report.

Considering the current turbulent times, it is prudent for conservative investors to remain in money market funds—not bond funds—on the sidelines.

3. Trend Tracking Indexes (TTIs)

The markets recovered from an initial decline after several Fed officials made reassuring remarks about bond yields. This triggered a positive reaction in the markets, but it did not alter our current bearish outlook as shown by our TTIs.

This is how we closed 10/9/2023:

Domestic TTI: -3.03% below its M/A (prior close –3.71%)—Sell signal effective 9/22/2023.

International TTI: -1.58% below its M/A (prior close -1.91%)—Sell signal effective 10/3/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli