ETF Tracker StatSheet

You can view the latest version here.

PUKING INTO THE WEEKEND

- Moving the markets

Another opening bounce in the markets turned out to be fake with the major indexes hitting the skids and not only diving into the weekend but also closing at the lows of the session with breadth worsening.

This marks the 5th day in a row of losses although, for this Holiday shortened week, the S&P 500 dipped only 1.67%, which is modest given the strong advances we have seen. Nevertheless, it’s the index’s worst week since about the middle of June.

Added ZeroHedge:

Every dip that was bought this week was met with more selling… that is NOT what the doctor ordered!! Everything looked great overnight but the cash equity open saw the selling begin and barely stop and the close was really ugly…

Apple didn’t help matters with the stock sliding some 3% due to a ruling that the tech giant no longer can force developers to use in app purchasing, which means, simply stated, they must give up some of their monopoly position.

What really hurt the markets and took a huge bite out of the Fed’s credibility stating that inflation is transitory, was the August Producer Price Index (PPI), which reflects a more realistic state of inflationary forces. The PPI showed wholesale costs for businesses rising 8.3% per annum, which was the biggest advance since 2010. For the month, the index raced ahead by 0.7%.

Bond yields rose, the US Dollar rallied, and Gold again was pulled below its $1,800 level. There was no place to hide with “SmallCaps” and “Value” all showing red numbers.

The question now remains whether there is more downside to come, and if so, will it be enough to trigger our trailing sell stops and subsequently our Trend Tracking Indexes (TTIs)?

No one has that answer, and we will have to wait and see how things play out, but this chart by Bloomberg indicates the ever-widening alligator gap, which eventually will snap shut.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

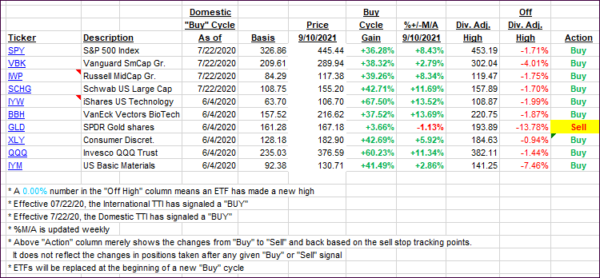

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs dropped with the Domestic TTI heading south for the 5th day in a row.

This is how we closed 09/10/2021:

Domestic TTI: +7.17% above its M/A (prior close +8.45%)—Buy signal effective 07/22/2020.

International TTI: +4.31% above its M/A (prior close +5.04%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

Contact Ulli