ETF Tracker StatSheet

You can view the latest version here.

WHEN BAD NEWS IS GOOD NEWS

- Moving the markets

The much-anticipated jobs numbers turned into a huge disappointment and were downright shocking when the BLS revealed that only 266k jobs were added vs. expectations of 1 million.

Worse yet was the fact that, when looking under the hood, as ZH pointed out, it became clear that had it not been for some 187k workers added in food service and drinking places (waiters and bartenders), as well as 72k in gambling, amusement and recreation workers, the April print would have been virtually unchanged from last month. Ouch!

Not to worry, the markets in their infinite wisdom took this economic horror show and concluded that bad news is good news again, which CNBC explained like this:

Investors bet that the big jobs miss could keep the easy policies of the Federal Reserve in place, including record low interest rates and a massive bond-buying program. Tech stocks, which have been winning under the low-rates regime during the pandemic, outperformed after the data release.

To make sure, you understand that today’s bad numbers were good news, Treasury Secretary Yellen came out and said this:

I would note that the jobs report is a little bit stronger than the headline numbers might suggest on the hiring front.

Huh?

Be that as it may, the markets surged, with the Dow setting another record, and all 3 major indexes closed in the green, with the Nasdaq leading for a change. Bond yields dipped and ripped with the 10-year almost unchanged, while the US Dollar plunged again.

Commodities continued their run to towards taking out the 2011 high with the index being up an amazing 65% YoY, which is a record spike, according to ZH.

All the uncertainty, with inflationary concerns on the rise, benefited Gold, which not only ended at $1,840, its highest level in 3 months, but also had its best week since last November.

I think, as inflation turns out not to be “transitory,” as the Fed would have us believe, the precious metal may just be in the early stages of a new bull run.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

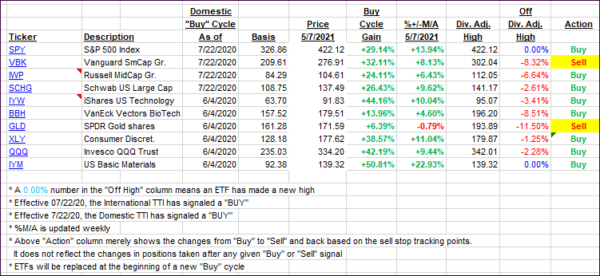

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs inched higher by a negligible margin.

This is how we closed 05/07/2021:

Domestic TTI: +20.37% above its M/A (prior close +20.18%)—Buy signal effective 07/22/2020.

International TTI: +17.82% above its M/A (prior close +17.40%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli