- Moving the markets

The current discussion amongst Wall Street strategists involves the question as to whether a test of the March lows is coming, or if investor FOMO (Fear Of Missing Out) is strong enough to keep driving the markets to ever higher levels.

With the country starting to reopen slowly, traders apparently have no sense in how this process will shake out in the weeks, months and years to come with the primary, and in my opinion erroneous, assumption being that we can turn on a switch and watch in awe how a V-shape type of recovery materializes.

Far from it, it will be a slow process, and I am pondering how many businesses have the wherewithal to remain shut until that moment in time arrives where their re-opening is “permitted.”

With the major indexes heading for their best monthly gain in many years, thanks to reckless monetary manipulation, I am still astounded by the lack of understanding by investors about the challenges involved to restart the US economy.

Commented Wolfe Research Analysts:

“Our sense is that the liquidity-driven ‘melt-up’ could persist over the near term. Ultimately, however, extremely weak fundamentals should matter. Along this vein, we expect the state reopening process to be much slower than what’s currently baked into stock prices.”

Today, we saw reality kick in, as the Dow gave up an early 400-point gain and closed in the red, as did all major indexes, with the loser of the day being the Nasdaq.

The early tumble came from a report that Boeing faces a criminal and civil probe over the 737MAX production, which was followed by more bad news, like Dr. Fauci’s grim assessment of the Covid-19 dilemma:

“So, it’s not going to disappear from the planet, which means as we get into next season, in my mind it’s inevitable that we will have a return of the virus or maybe it never even went away. When it does, how we handle it will determine our fate,” Fauci commented overnight, adding that he was “almost certain” the virus will return in the winter.“

That caused the early short-squeeze to run out of steam, and the markets were forced to take the path of least resistance—down.

The Fed is on deck and scheduled to talk about interest rates and the economy tomorrow. For sure, it will be market moving, but which way?

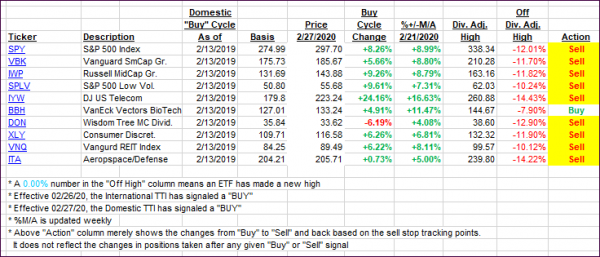

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this past domestic “Buy” cycle, which ended on 2/27/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

In my advisor practice, we may or may not be invested in some of the 10 ETFs listed above.

3. Trend Tracking Indexes (TTIs)

Our TTIs enhanced their positions with especially the Domestic one heading closer to its long-term trend line.

This is how we closed 04/28/2020:

Domestic TTI: -9.34% below its M/A (prior close -10.58%)—Sell signal effective 02/27/2020

International TTI: -12.25% below its M/A (prior close -12.85%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli