ETF Tracker StatSheet

You can view the latest version here.

HOMING IN ON ALL-TIME HIGHS

- Moving the markets

The markets got an early lift from retail sales, despite the August report showing a mixed picture. While purchases of new autos and building supplies contributed to the rise of 0.4% last month, most other stores reported weak or declining receipts, which appears to be a sign that consumers have trimmed their spending.

Equities slipped throughout the session with only the Dow closing in the green and scoring its 8th straight gain. The Dow and S&P 500 are now within striking distance of fresh all-time highs, which may very well happen next week in anticipation of the Fed not disappointing and lowering interest rates next Wednesday.

Trade tensions with China appeared to have softened a tad, at least for the time being, in that China exempted US agricultural products from tariffs. That overture came after reports that an interim trade deal has been struck.

Still, something odd is happening in the relationship between bond yields and equity prices. The 10-year yield surged again by almost 13 basis points, a huge move, which many traders consider a bond bloodbath. That should have been headline news but was barely mentioned in the press.

Despite all the rhetoric about lower rates, mortgage rates have shot up, and the 10-year bond yield, which a few weeks ago was at 1.47%, has spiked to 1.90% without as much as a hiccup in equities. Even the 30-year yield climbed an amazing 33 basis points this week, a surge that is the second biggest since 2009.

The rotation out of well-performing momentum stocks into the cyclical and value arena continued, as higher yields impacted low volatility ETFs, such as SPLV and USMV. While they lagged in performance, they are still holding on to their YTD lead over SPY.

We’re living in a such a distorted system where, as of today, Greek 10-year bond yields are now below US 10-year yields for the first time since 2007. For the uninitiated, that means, at least in theory, Greece is less of a default risk than the US.

Go figure…

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

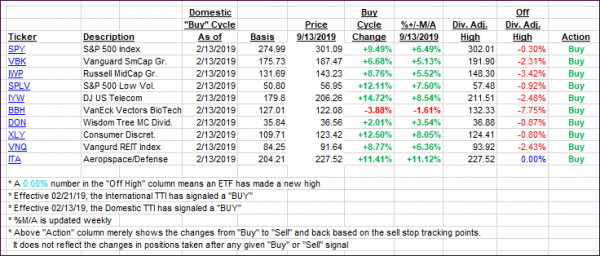

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed today with the Domestic one slipping while the International one edged out a gain.

Here’s how we closed 09/13/2019:

Domestic TTI: +6.05% above its M/A (prior close +6.43%)—Buy signal effective 02/13/2019

International TTI: +3.46% above its M/A (prior close +3.21%)—Buy signal effective 09/12/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli