ETF Tracker StatSheet

You can view the latest version here.

TRADE WORRIES CONTINUE TO DISSIPATE; S&P 500 UP FOR DAY BUT DOWN FOR THE MONTH

- Moving the markets

An early rally bit the dust with the major indexes losing upside momentum, dipping into the red and bouncing around their respective trend lines throughout most of the session. A last hour push helped the Dow and S&P back into the green, but the Nasdaq fell just short and closed down a tad. For the month, Transportation and SmallCaps fared the worst, while the Dow and S&P lost the least.

Helping this week’s comeback was the proper dangling of the trade carrot, which helped the markets climb out of last Friday’s deep hole, while recovering some of the losses sustained in this volatile month of August.

It sure paid to be invested in the less volatile SPLV, which gained +2.14% vs. the S&P 500’s loss of -1.8%. Since our Domestic ‘Buy’ cycle in February, SPLV has gained 11.69% vs. the SPY’s +6.35%.

With the US-China trade talks, or rather lack thereof, having taken centerstage, one analyst described the impasse as follows:

“Despite U.S. tariffs on $300 billion worth of Chinese goods set to be raised beginning Sept. 1, another round of trade talks could take place in the month ahead. Such a possibility allows markets to continue clinging on to hope that a resolution to this protracted impasse is not dead in the water, with traders using this as an excuse to push further into risk-on territory at any given opportunity.”

And there you have it. It’s either US-China words of hope for any improvement in trade relations or dovish jawboning from the Fed, with either one of those events being the drivers of equities; fundamentals be damned.

Buybacks gave an assist to the markets on several occasions, as this chart by ZH clearly shows. Selected short squeezes also had an impact, as you can see here, although they weakened towards the end of the month.

We’re now staring the always volatile September in the face, and I’m sure it won’t be smoothing sailing. Our trailing sell stops are ready to be executed, should the need arise.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

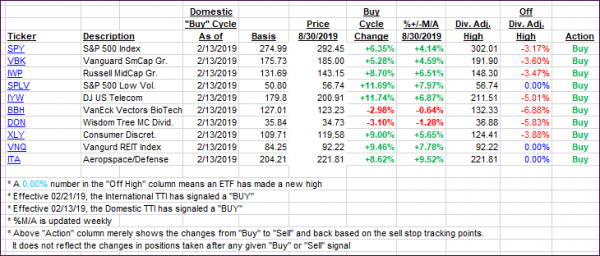

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed with the Domestic one slipping, while the International gained.

Here’s how we closed 08/30/2019:

Domestic TTI: +2.36% above its M/A (prior close +2.45%)—Buy signal effective 02/13/2019

International TTI: -0.63% below its M/A (prior close -1.05%)—Sell signal effective 08/15/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli