ETF Tracker StatSheet

MAJOR INDEXES GAIN FOR THE DAY BUT PULL BACK FOR THE WEEK

[Chart courtesy of MarketWatch.com]- Moving the markets

The markets simply ignored Intel’s poor results from yesterday, as optimism about the earnings season kept the bullish theme alive, despite reports that global growth has slowed. While this eventually will affect earnings of multi-national companies, right now, however, traders are looking past those concerns as well as disregarding the divisions in Washington or the fact that GDP may slow down to zero.

The major indexes headed higher right after the opening bell but gave back some of their early gains throughout the session. We ended up on the plus side, but the S&P 500 fell short of recovering some of its losses sustained early in the week.

Still, the headlines were anything but awe inspiring with the all-important durable goods report missing in action due to the government shut-down.

ZH had this succinct comment:

While ‘bad news’ has been signaling ‘good news’ recently (the worse the economy gets, the more dovish Powell becomes… so buy stocks?) – the circular logic of that goldilocks argument is starting to crumble as ‘hope’ has crashed in recent weeks and it is ‘hope’ that keeps the dream alive (e.g., in the short term, economic weakness is bullish for stocks; but in the longer-term, ‘hope’ remains that a dovish Fed will lift the economy and everything will be awesome and the economy will catch up to stocks).

The death of hope… the spread between ‘soft’ survey data and ‘hard’ real economic data has collapsed – removing ‘hope’ from the equation…

That leaves the major driver of the market as being the Central Bank balance sheet expansion. I have featured the chart before but it’s worth looking at again, if you are still unsure as to what prompts these rallies out of nowhere and with lightening speed. To be clear, there are other factors coming into play as well, such as another giant short squeeze that helped elevate the SmallCap sector.

We remain in bear market territory, but our Trend Tracking Indexes (TTIs) have improved markedly and are moving closer to a potential new “Buy” signal (see section 3). Stay tuned…

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

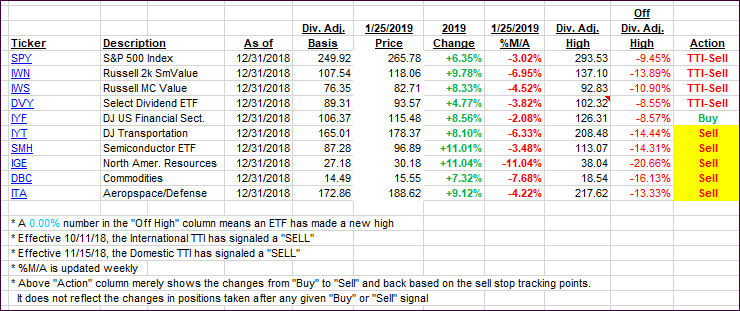

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our original candidates from the last cycle have fared:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) jumped and moved closer to their respective trend lines.

Here’s how we closed 01/25/2019:

Domestic TTI: -1.86% below its M/A (last close -2.90%)—Sell signal effective 11/15/2018

International TTI: -2.00% below its M/A (last close -3.20%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling.

———————————————————

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli