ETF Tracker StatSheet

ANOTHER TARIFF TANTRUM

[Chart courtesy of MarketWatch.com]- Moving the markets

A variety of factors combined to deliver another market knockout punch. Things looked dicey from the opening bell when the jobs report disappointed by delivering on 103k new jobs in March vs. an expected 170k. That was the good news.

The bad news continued in the China-U.S. trade fight as Trump proposed fresh tariffs. Relentless selling continued in the afternoon after Fed chairman Powell’s well intended speech discussing his support for a “patient” approach to raising interest rates fell on deaf ears and did nothing but accelerate downward momentum.

Then Trump confirmed that in regards to the effect on markets as a result of the trade standoff “I’m not saying there won’t be a little pain so we might lose a little of it but we’re going to have a much stronger country when we’re finished, and that’s what I’m all about.”

These were not exactly words designed to calm shattered nerves, and the VIX jumped to a 7 year high. Now barely 3 months into 2018, already we’ve seen no fewer than 22 sessions with intra-day moves in the Dow of 400+ points. Compare that to 2017 where we had 1 (hat tip to ZH for this stat)!

The S&P 500 did a repeat and for a brief moment broke through its 200-day M/A to the downside, for the 4th time this month, but it managed to close above it by a small margin. To me, it now looks to be just a matter of time until this level is broken, which may mean a return to bear market territory.

Our Trend Tracking Indexes (TTI) confirm that we are near an inflection point, which means that the current bullish cycles are coming to an end should downside momentum continue.

How close are we? While our TTIs survived this day and remain on the bullish side of their respective trend lines (see section 3), we are within striking distance (around +0.5%) of breaking below them. Once that occurs, the odds are increased that a new bear market will be upon us. That is when the rubber meets the road, and we will step aside to the safety of the sidelines.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

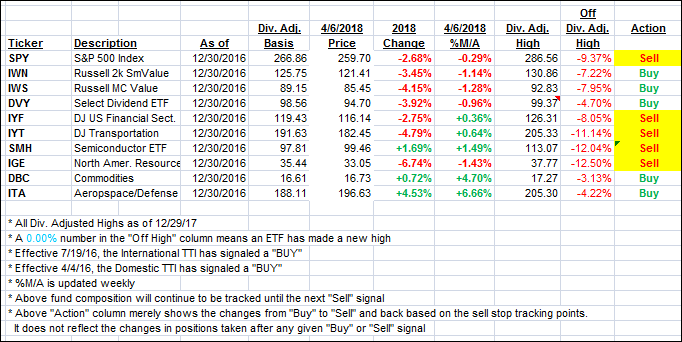

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) rallied as the bullish momentum continued.

Here’s how we closed 4/6/2018:

Domestic TTI: +0.59% above its M/A (last close +1.53%)—Buy signal effective 4/4/2016

International TTI: +0.32% below its M/A (last close +1.54%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli