ETF Tracker StatSheet

https://theetfbully.com/2017/12/weekly-statsheet-etf-tracker-newsletter-updated-12-28-2017/

DIVING INTO THE CLOSE

[Chart courtesy of MarketWatch.com]- Moving the markets

It’s no secret that equities had a stellar 2017 with the major indexes posting their best year since 2013. It was a period during which the Dow hit 71 closing records, while the Nasdaq rose for its sixth straight year, its longest such streak since the one lasting from 1975 to 1980. All three indexes added solid gains for December but dove into the close as the bears notched a rare and tiny victory, which can be attributed to low volumes and lighter-than-average liquidity.

Consequently, green numbers were hard to come by as only Emerging Markets (SCHE +0.47%), International SmallCaps (SCHC +0.08%) and International Equities (SCHF +0.03%) closed up. All other ETFs in our portfolios puked on the last trading day of 2017 with SmallCaps (SCHA -0.75%) losing the most and the Dividend ETF (SCHD -0.25%) holding up the best.

Interest rates dropped with the 10-year bond yield surrendering 3 basis points to end the year at 2.40%. Crude Oil bounced back above $60 while gold climbed above the $1,300 level for the first time since late August. I am curious to see if the metal gets spanked again come next Tuesday, which historically has been the day of punishment.

The US Dollar (UUP) continued with its function as the whipping boy of the year by gapping down for the third day in a row (-0.41%) to a level last seen in September. For the year, UUP showed an ugly performance by losing some 10%.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

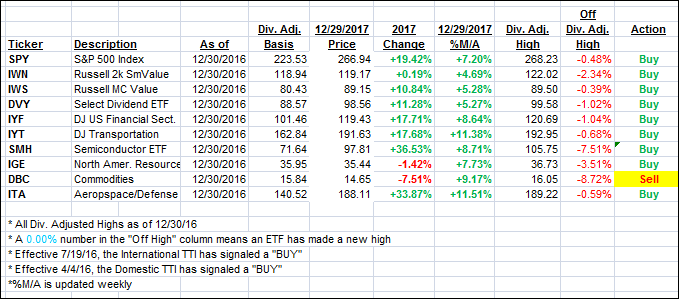

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed south as the major indexes stumbled into the close.

Here’s how we closed 12/29/2017:

Domestic TTI: +3.50% above its M/A (last close +3.87%)—Buy signal effective 4/4/2016

International TTI: +4.80% above its M/A (last close +5.14%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli