ETF Tracker StatSheet

https://theetfbully.com/2017/12/weekly-statsheet-etf-tracker-newsletter-updated-12072017/

NEW RECORDS POWERED BY JOBS REPORT

[Chart courtesy of MarketWatch.com]- Moving the markets

The headline report about the latest jobs numbers showing an improvement in November, 228k created vs. 200k expected, was enough to power the major indexes higher with both the Dow and S&P 500 ending the week in record territory. The tech sector closed down for the second week in a row.

Never mind that Consumer Confidence tumbled for the second month in a row. Never mind that wage growth disappointed and never mind that the bulk of the job growth took place in minimum-paying jobs. And yes, in case you were wondering, waiters and bartenders did hit a new all-time high of 11.783 million in November.

None of that was relevant as we’re back to the “any news is good news” scenario. Of course, our ETF space benefited as we saw all green numbers with only one exception. Heading the winners were the Emerging Markets (SCHE) with +1.03%, followed by Financials (XLF) with +0.61% and MidCaps (SCHM) with +0.59%. Not participating in this rally were Semiconductors (SMH), which gave back -0.46%.

Interest rates rose modestly with the yield on the 10-year bond adding 1 basis point to close the week at 2.38%, while the more volatile high-yield sector (HYG) held steady. Gold slipped again and lost -2.5% over the past 5 trading days, which was its biggest drop in 7 months. The US Dollar (UUP) added +0.16% and had its first 5-day win streak since March.

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

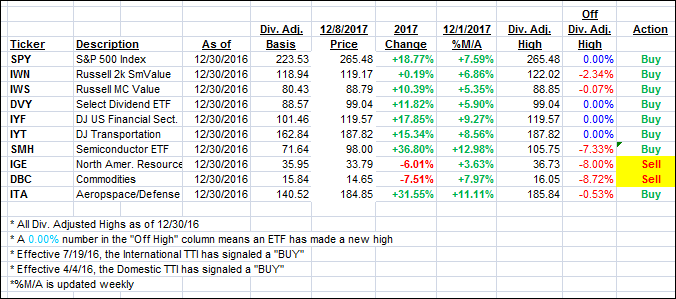

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) barely changed as all moving averages were recalculated today.

Here’s how we closed 12/08/2017:

Domestic TTI: +3.38% above its M/A (last close +3.39%)—Buy signal effective 4/4/2016

International TTI: +5.37% above its M/A (last close +5.07%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli