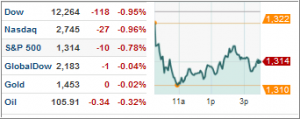

There was no green number to be found in today’s market pullback, as the chart from MarketWatch clearly shows.

There was no green number to be found in today’s market pullback, as the chart from MarketWatch clearly shows.

It was a day during which recovery worries clearly surfaced as it appeared that the economy may not be as strong as had been previously assumed. While these inconvenient thoughts have surfaced from time to time, bullish sentiment has always won in the recent past.

Whether this is the start to more downside activity is simply too early to tell. The sell off was broad and covered equities, crude oil, gold, commodities and emerging markets. Bonds bucked the trend as interest rates headed lower.

Reports surfaced that high gasoline prices have changed driving habits for many, while consumption has dropped in all 50 states as convenience-store sales were affected negatively.

Oil came off its high as several factors combined, such as an oil demand slowdown report, the IMF trimming its growth forecasts for the U.S. and Japan and Goldman Sachs advising clients to reduce their oil positions.

Adding to the uncertainty was Japan’s nuclear issue as the rating of the severity was raised to 7, which puts it on par with the 1979 reactor meltdown at Three Mile Island in Pennsylvania.

That fact started the markets in negative territory. Late afternoon bargain hunting cut down on the losses, but upward momentum was insufficient to turn this down day around.

Contact Ulli