1. Moving the Markets

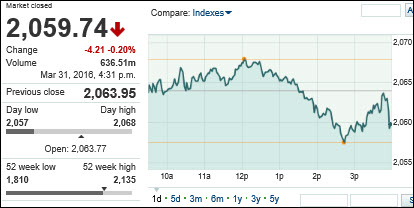

Who would have thought that markets would be in positive territory at the end of March, given the horrendous start to the year. As of the closing bell, the Dow and S&P 500 are officially both in positive territory YTD.

At the pinnacle of fearing Bears may take over, which was around mid-February, all of the major domestic indexes had fallen more than 10% for the year. Today, the S&P 500 is up 1% YTD and with the Dow not far behind. Of course, as MSM media conveniently does not mention, this mysterious recovery did not generate any new profits for those who were in the market, it merely wiped out the losses that occurred during the first six weeks of 2016. As trend followers, we are very well aware of that fact.

Domestic stocks are now riding a 2-day rally wave that Janet Yellen started on Tuesday after reiterating that the nation’s central bank is in no rush to hike interest rates AKA pleasing Wall Street. However, Wall Street is still awaiting economic data to be released tomorrow.

As we discussed on Monday, Friday we will hear about the jobs report for March, which will have an impact on the Fed’s stance regarding the state of the economy and potential interest rate hikes. If the report comes in way below expectations, we could either see a swoon in equities as disappointment reigns supreme or another sharp leg higher, as Wall Street would expect the Fed to start more Quantitative Easing. Which will it be?

We’ll have to wait until tomorrow to find out.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

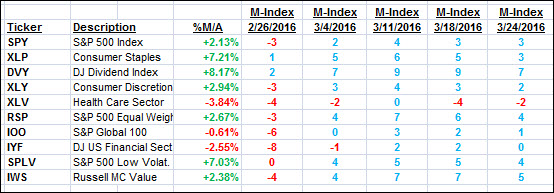

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

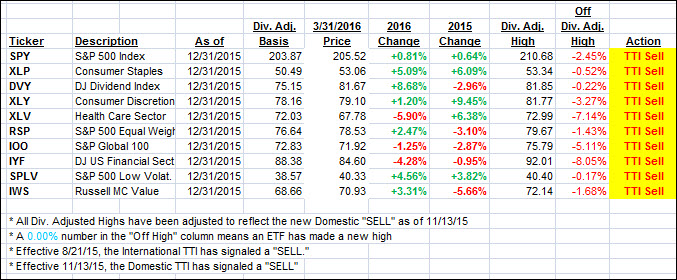

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) slipped as the markets were fairly quiet in anticipation of tomorrow’s employment data.

Here’s how we closed:

Domestic TTI: +0.95% (last close +0.99%)—Sell signal effective 11/13/2015

International TTI: -2.05% (last close -1.96%)—Sell signal effective 8/21/2015

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli