ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

HEIGHTENED VOLATILITY; BUT INDEXES GAIN FOR THE MONTH

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Despite a sharp increase in volatility during July, the S&P 500 managed to regain its footing to close out the month with a 2% advance with the past week accounting for most of the gain. This rebound came in the face of a 5-day losing streak, during which the index surrendered 2.9%.

While today’s session was sluggish due to disappointing results from Exxon and Chevron, there was one surprise economic data point. Wages and salaries rose in the second quarter at the slowest pace on record, which means that despite an improving labor market, increases in pay are far from certain, which makes me question if the labor market is really showing signs of life. As a consequence, the Fed will have to do some serious thinking and evaluating as to whether a planned interest increase is actually justified.

Our 10 ETFs in the Spotlight showed a mixed picture today with 5 of them advancing and 5 of them declining. Leading the advances was Healthcare (XLV) with +0.58%; on the losing side, the Global 100 (IOO) gave back the most by dropping -0.34%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

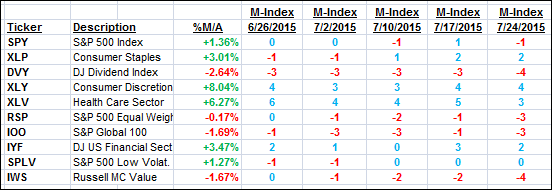

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

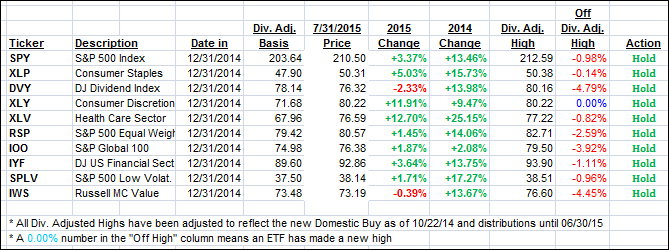

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) followed the bullish trend of the week and closed higher:

Domestic TTI: +1.47% (last Friday +0.80%)—Buy signal effective 10/22/2014

International TTI: +1.25% (last Friday +0.63%)—Buy signal effective 2/13/2015

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

Reader Larry:

Q: Ulli: Thanks for your online free service, it is appreciated.

My question has to do with using a 39 week simple moving average. I noticed that when the chart is looked upon at the end of the week when it is updated that it is easy to see the price relation to the moving average. You report often where the TTI is in the middle of the week for instance my question is how do you know what the weekly moving average number is until the end of the week? I would appreciate your input.

A: Larry: The answer is simple. I update the TTI prices daily to not only show the changes but to also to be prepared for a trend line crossing and the resulting ‘Buy’ or ‘Sell’ signal.

Since I use a weekly moving average (M/A), that number is only calculated every Friday, and I usually have it updated/corrected in the ETF/Mutual Fund Tracker by about 6 PM PST. It remains the same until the following Friday when it gets recalculated again.

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli