ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

STOCKS LOWER ON THE WEEK

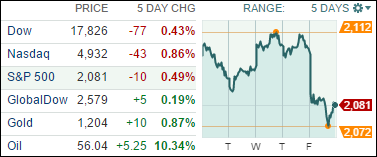

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks declined this week, closing down about 0.5% as measured by the S&P 500. The markets bounced around in a narrow range for the most part as investors got their first look at Q1 earnings, but ultimately finished with a pullback Friday on international headlines out of Greece and China and mixed U.S. data.

In tech today, Apple’s (AAPL) stock is down $1.53 cents, or 1.2% this Friday. Some investors and analysts are still holding out hope for Apple’s $1 trillion dream, but many remain pessimistic at present. The current 18-month price target on Apple is $142.42 a share, which equates to an expected market value of $829.6 billion. Still a long ways to go before hitting the Trillion dollar mark!

In auto news today, Ford (F) confirmed that it is investing $2.5 billion in new engine and transmission plants in the Mexican states of Chihuahua and Guanajuato. The investment, which Ford says will created 3,800 direct jobs, has been widely expected this week and it follows an announcement by Toyota (TM) on Wednesday that it is spending $1 billion in Mexico on a new factory to build redesigned 2020 Corolla compacts starting in 2019.

As earnings season continues in the coming few weeks, more volatility could return to the markets, underscoring the importance of having an exit strategy, should things go south too much and into bearish territory. First-quarter earnings season will likely set much of the tone for the week ahead. In addition, existing home sales will be reported on Wednesday. New home sales are expected Thursday, and durable goods orders are expected on Friday.

All of our 10 ETFs in the Spotlight pulled back today as downward momentum was too much to overcome. Leading the charge into the red was XLY with -1.48% while DVY held up best with a loss of -0.83%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

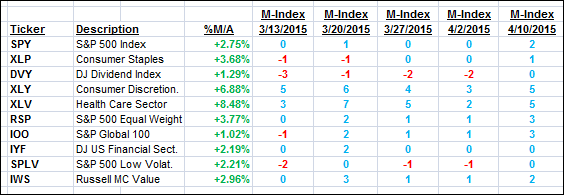

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

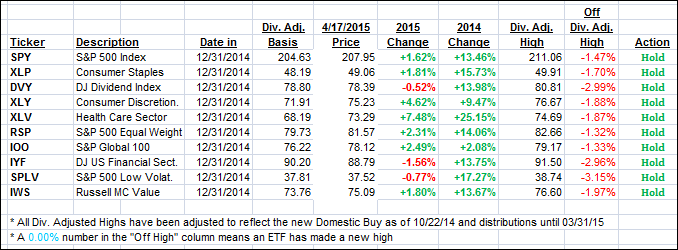

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped and ended the week as follows:

Domestic TTI: +2.88% (last Friday +3.31%)—Buy signal effective 10/22/2014

International TTI: +4.30% (last Friday +4.95%)—Buy signal effective 2/13/2015

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Norman:

Q: Ulli: Since XLV has been a top performing index fund for many years, why not consider CURE?

A: Norman: The time to use a 3X leveraged ETF like CURE would have been at the beginning of the cycle and not this far into it. However, if your risk tolerance allows such leverage, then by all means go for it. I prefer the slow and steady approach, because it is more suited to trend tracking as it minimizes potential whip-saw signals.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli