ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, December 12, 2014

MARKETS END LOWER ON THE SECOND WEEK OF DECEMBER

[Chart courtesy of MarketWatch.com]1. Moving the Markets

After seven consecutive weeks higher, stocks fell as they took their lead from poor global economic data and declining oil prices. On the week, the S&P 500 fell 3.5%, the Dow dropped 3.7%, and the Nasdaq slid 2.6%.

It seems that Wall Street is very nervous about the price of oil and the situation in the EU. With oil at a five-year low and overseas markets also slowing, persistent weak inflation has allowed Federal Reserve policymakers room to keep interest rates near zero after ending monthly asset purchases in October as the economy allegedly strengthened.

In labor news, the Labor Department says the producer price index fell 0.2% in November, after rising by the same amount in October. In the past 12 months, producer prices have risen just 1.4%, the smallest yearly increase since February.

The bet and hope is now on the American consumer to boost retail sales throughout the month of December.

With today’s sell off, our International TTI has now officially entered bear market territory. Please see section 3 for more details.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

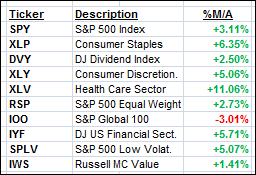

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

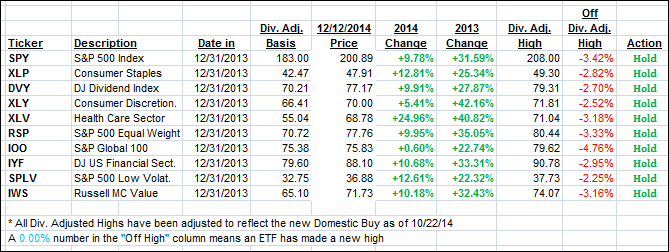

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed south with the International one now clearly settling below its trend line and in bear market territory. Barring any huge rebound on Monday, this short Buy cycle is over as bearish momentum makes this arena too risky to be exposed in.

It remains to be seen if the International TTI is again the canary in the coalmine alerting us early of things to come.

Here’s how we ended this volatile week:

Domestic TTI: +1.82% (last Friday +3.46%)—Buy signal since 10/22/2014

International TTI: -1.60% (last Friday +1.62%)—New Sell signal effective 12/15/14

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Dick:

Q: Ulli: In following the 7.5% rule, I cashed in my mutual fund shares at about 8% when the markets turned bearish in the middle of October. Being reluctant to get back in over the following week, I missed a complete upside return to where I was when I got out.

The problem with mutual funds is that they don’t like you redeeming your shares and then returning to the market every other day or so. My apprehension kept me on the sidelines and I have paid the price.

Your input regarding this problem in dealing with mutual funds.

A: Dick: Yes, that’s been an old problem that we avoid by using ETFs. I manage a few 401k accounts for clients, where mutual funds are mandatory, but I predominantly use the equivalent index fund for the S&P 500. Since a whipsaw does not happen very often, this has not been an issue for us.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli