1. Moving the Markets

Stocks ended in a similar fashion to last Friday, mostly lower despite encouraging economic data and a plethora of corporate deals. The S&P 500 managed to stay above the 2,000 mark after dropping 0.07%, closing at 2,002.28. The Dow fell 0.18%, while the Nasdaq gained 0.39%.

On the economic front, two reports were released today that pointed to stronger U.S. economic growth. The Institute for Supply Management, a trade group, said its gauge of manufacturing rose to 59 in August, buoyed by new orders for goods and increased production. Anything above generally 50 signals growth.

Dollars and Dollars were back in M&A news today as Dollar General (DG) raised its bid from $78.50 to $80 a share, for its rival Family Dollar (FDO). That tops Dollar Tree’s (DLTR) offer of $74.50 for Family Dollar. All three stocks rose: Dollar General was up 0.6% to $64.36, Family Dollar gained 0.5% to $80.22 and Dollar Tree jumped 1.6% to $54.46.

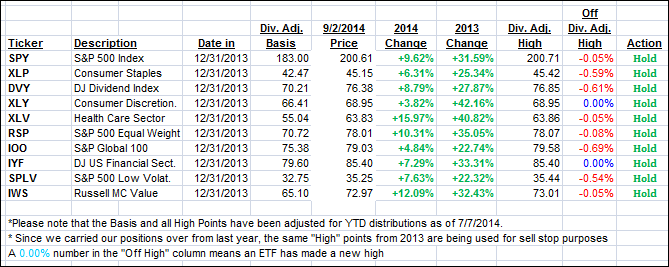

3 of our 10 ETFs in the Spotlight managed to eke out a gain today with 2 of them making new highs for the year.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

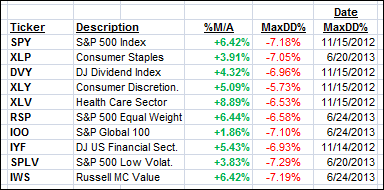

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) changed only slightly as the major indexes showed no clear direction:

Domestic TTI: +3.20% (last close +3.22%)

International TTI: +2.71% (last close +2.59%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli