ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, June 27, 2014

RIDING THE ROLLER COASTER

[Chart courtesy of MarketWatch.com]1. Moving The Markets

Today’s reversal from an early sell off pretty much resembled the activity of the past 5 trading days as the chart above shows. While we did not recover all of the losses, the S&P 500 ended within 2 points of where it had closed last Friday.

Helping today’s rebound was the end-of-the quarter re-balancing of portfolios by institutions with the main beneficiary being the Nasdaq, which got pushed above the unchanged line. For the week, this index outperformed the S&P and Dow by gaining 0.7%.

The only economic data point for the day was the release of the consumer sentiment, which rose to 82.5 in June from 81.9 in May. That does not mean all is well for the overburdened consumer as retail, especially discretionary, which is represented in one of our 10 Spotlight ETFs (XLY), has been lagging all year and is not showing any signs of a recovery.

Some of our 10 ETFs in the Spotlight gained for the week; no new highs were made today and all of them are now in the green YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

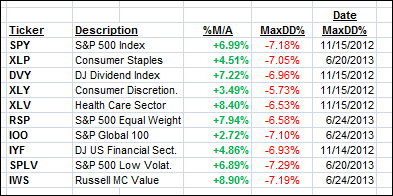

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

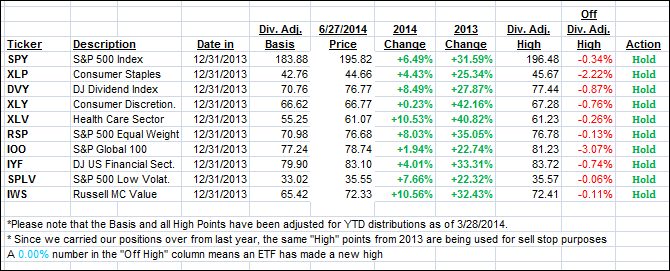

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed with both of them retreating slightly:

Domestic TTI: +3.63% (last Friday +3.68%)

International TTI: +3.92% (last Friday +4.66%)

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader David:

Q: Ulli: Do your performance figures for ETF’s in the Spotlight assume reinvestment of cash dividends? Either way, how do you adjust performance figures to accurately reflect the gain?

A: David: For simplicity sake, I use dividend adjusted prices for the basis as the YTD table shows. Therefore, dividends are not reinvested, and the performance displayed represents the change in prices only for the period shown.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli