ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, December 27, 2013

EQUITIES POISED FOR BEST YEAR SINCE 1997

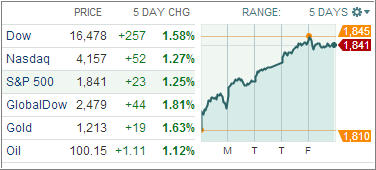

[Chart courtesy of MarketWatch.com]1. Moving The Markets

The equity markets look to be closing in on a stellar year, bolstered by ongoing Federal Reserve stimulus and the alleged return of a robust U.S. economy. Though rising throughout the morning today, major U.S. markets reversed direction by midday, if only minimally, seemingly putting the brakes on a “Santa Claus” rally which propelled the Dow Jones Industrial Average to a record closing high on Thursday. Even so, with only three trading sessions left in 2013, equities are set to end the year with the best performance since 1997.

The bond/treasuries bears are awaking from hibernation it seems as U.S. benchmark government bond yields increased to more than 3% on Friday, a two-and-a-half year high. The U.S. 10-year Treasury note yield topped 3.02%, which is usually a sign the U.S. economy is steadily improving.

Even if you believe the numbers, an estimated 1.3 million long-term unemployed workers will lose essential federal unemployment benefits on Saturday, a product of the bipartisan federal budget agreed upon this month to curtail government spending. The number of long-term unemployed ballooned to more than 6.7 million in the first half 2010 but has since declined to 4 million.

Seven of our ten ETFs in the spotlight made new highs today; the remaining three have pulled back only slightly.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Now let’s look at the MaxDD% column and review the ETF with the lowest drawdown as an example. As you can see, that would be XLY with the lowest MaxDD% number of -5.73%, which occurred on 11/15/2012.

The recent sell off in the month of June did not affect XLY at all as its “worst” MaxDD% of -5.73% still stands since the November 2012 sell off.

A quick glance at the last column showing the date of occurrences confirms that five of these ETFs had their worst drawdown in November 2012, while the other five were affected by the June 2013 swoon, however, none of them dipped below their -7.5% sell stop.

Year to date, here’s how the above candidates have fared so far:

3. Domestic Trend Tracking Indexes (TTIs)

Looking at the big picture, our Trend Tracking Indexes (TTIs) advanced with the overall positive tone in the market and remain above their long term trend lines by the following percentages:

Domestic TTI: +4.58% (last Friday +4.31%)

International TTI: +7.05% (last Friday +5.95%)

Have a great week.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Jack:

Q: Ulli: I like your new format the daily market commentary.

Will you continue showing these ETFs in the spotlight new year?

A: Jack: Yes, I will update these 10 ETFs every day along with a continuation of their “High” points and 2014 YTD figures in a newly added “Change” column.

Keep in mind that a new year does not change any of the calculations in regards to determining the trailing sell stop points. Of course, I need to point out that you may have different “High” points depending on your purchase date of the ETFs.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli