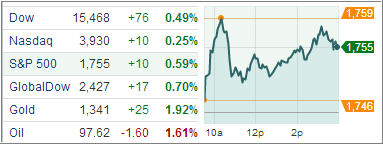

U.S. equities finished higher, despite a softer-than-forecasted U.S. September nonfarm payroll report. The data may have solidified expectations that the Federal Reserve may hold off on tapering its asset purchases until signs of a healthy economy become more lucid.

Speculation pushed the annual advance in the Standard & Poor’s 500 Index within a percentage point of the best yearly gain in a decade. Treasuries finished solidly higher following the jobs report, overshadowing positive reads on construction spending and manufacturing activity in the Mid-Atlantic region. Gold was higher, while crude oil prices and the U.S. dollar lost ground.

Earnings reports continue to come in earnest, with mostly positive results. Netflix beat earnings expectations, as did Texas Instruments, but the chipmaker’s shares suffered after it issued disappointing 4Q guidance. Moreover, Dow member Travelers Companies bested the Street’s projections and authorized a $5 billion stock buyback plan, and Dow member DuPont reported upbeat earnings.

Equity indices opened in positive territory after the September nonfarm payrolls report missed expectations. While the disappointing report underscored the subpar condition of the labor market, traders did not appear too concerned with the news knowing the Federal Reserve has pledged to maintain its loose monetary policy until conditions improve notably. Nine of ten sectors posted gains while technology (-0.2%) underperformed after enduring some late-morning weakness.

Even though the tech sector briefly pressured the Nasdaq into the red, the S&P was underpinned by several influential groups like consumer discretionary (+0.7%) and energy (+0.7%).

Interestingly, the energy sector rallied even as crude oil fell 1.4% to $98.30 per barrel. Three of four countercyclical sectors outperformed as consumer staples, health care, and utilities advanced 1.4%, 0.9%, and 1.3%, respectively.

Our Trend Tracking Indexes (TTIs) followed suit and closed higher with the Domestic TTI now sporting +5.00% while the International TTI reached a level that is +9.13% above its long term trend line.

Contact Ulli