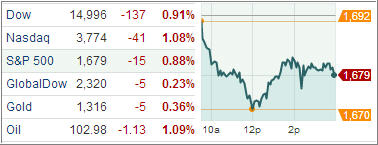

Domestic equities slipped for the second-straight session on Thursday, with the Standard & Poor’s 500 Index dropping the most in a month, as global and domestic investors continue to anxiously await resolutions from Congress to solve Washington’s budget crisis.

The situation has now partially shut down the government for three days, while the debt ceiling limit is swiftly approaching. So far market losses have been limited during shutdowns, but they did reach about 17 percent in the summer of 2011 just before the debt ceiling was raised. Should this end up in similar fashion, it pays to have your sell stops ready to be executed.

Equities retreated throughout the morning before finding support in the early afternoon following an article in The New York Times indicating Speaker of the House John Boehner told Republicans he would not allow a default to take place. Thanks to the rebound, the S&P was able to erase a third of its losses, but could not close above its 50-day moving average (1680). All ten sectors ended in the red with influential groups like consumer discretionary (-1.0%), industrials (-1.1%), and technology (-1.0%) leading to the downside.

Notably, industrials finished near the bottom of the leaderboard for the second consecutive day. The Dow Jones Transportation Average also underperformed, slumping 1.1%, even as airlines displayed relative strength.

Elsewhere, the technology sector saw its top components, Apple, Google, and Qualcomm, lose between 0.8% and 1.4% while chipmakers outperformed. Countercyclical groups ended mixed as consumer staples (-0.5%) and telecom services (-0.4%) finished ahead of the S&P while health care (-1.0%) and utilities (-1.2%) lagged.

In economic news, the ISM Non-Manufacturing Index showed that services sector growth slowed more than expected, with the business activity/production and employment components posting solid declines. Although today’s report was on the disappointing side, economic activity in the non-manufacturing sector grew for the 45th consecutive month.

Meanwhile, weekly initial jobless claims rose 308,000 last week, below the 315,000 level that economists had expected. However, the four-week moving average dropped to 305,000. Treasuries were mixed following the data, which included weekly initial jobless claims increasing by a smaller-than-expected amount.

Our Trend Tracking Indexes (TTIs) slipped as well and ended at +2.95% (Domestic TTI) and +6.37% (International TTI). The recent pullback did not yet trigger any trailing sell stops or caused any trend line breaks for our holdings.

Contact Ulli