U.S. equities concluded a lackluster day of trading hovering near the flatline during the final hour of the session, before ultimately ended lower, extending their recent slide to a fourth session as worries over a possible U.S. government shutdown added to investor caution.

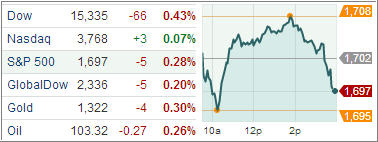

The market’s recent losses mark the longest losing streak since last month for the S&P 500, which has been down every session since rallying 1.2 percent last Wednesday on the Fed announcement. Meanwhile, Treasuries were mostly higher, despite a report that showed housing prices gained ground again in July, while separate releases for September showed consumer sentiment declined more than expected.

Though uncertainty remains over the Federal Reserve’s intentions to scale back its stimulus since the central bank’s decision last week to leave its current program unchanged, some of the focus for now has turned to Capitol Hill. Stocks slipped during the opening hour in reaction to a below-consensus consumer confidence report for September. Gains in the stock market were unable to thwart pessimism in the labor market as the September Consumer Confidence Index fell to 79.7 from an upwardly revised 81.8 (from 81.4) in August. Economists expected the Index to drop to 80.0. Despite the opening slip, the S&P recovered swiftly, but was unable to hold the 1,700 level into the close as financials and technology weighed.

The financial sector (-0.6%) underperformed for a second consecutive day with JPMorgan Chase leading to the downside. The stock fell 2.2% after The New York Times revealed the Department of Housing and Urban Development sought a $20 billion settlement in a mortgage-backed securities issuance case against the bank.

Even though the S&P ended in the red, there were some pockets of strength among cyclical sectors like industrials and consumer discretionary. Industrials (+0.3%) finished in the lead thanks to all-around support. The largest sector component, General Electric advanced 0.2% and transportation companies also outperformed.

The Dow Jones Transportation Average added 0.1%. Meanwhile, the discretionary sector (XLY, +0.1%) saw homebuilders rally. Housing stocks also drew strength from continued gains in home prices as the July Case-Shiller 20-city Index rose 12.4% and the FHFA Housing Price Index improved by 1.0%. The iShares Dow Jones US Home Construction ETF (ITB) gained 1.8%.

Our Trend Tracking Indexes (TTIs) were mixed with the Domestic TTI inching higher to +3.44% while the International TTI retreated to +7.27%.

Contact Ulli