- Moving the market

The morning started like a dream: Nvidia dropped an absolute monster quarter—beat earnings, smashed revenue, and gave guidance that had Jensen basically saying, “Blackwell demand is insane, no bubble here.”

The stock jumped 4% pre-market, the whole AI ecosystem lit up (AMD, Broadcom, Eaton—you name it), and everyone thought the AI bull was officially back in charge.

Then the September jobs report hit: 119K jobs added (better than feared), but the unemployment rate ticked higher.

That flipped the script—December rate-cut odds actually rose mid-session (traders love a little labor-market weakness). Everything looked golden… until it very much wasn’t.

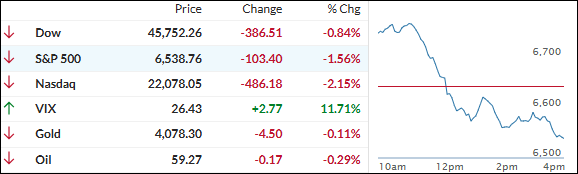

By afternoon it turned into one of the nastiest reversals I’ve seen all year. Nasdaq swung a ridiculous 5% from high to low and never recovered. Mega-caps, retail darlings, pretty much everything got taken out back and spanked.

Nvidia closed down on the day—yes, you read that right—after being up double-digits intraday. Classic “pump it, dump it” move.

Bonds caught a safe-haven bid (yields dipped), bitcoin got crushed below $90K (lowest since April), and the dollar crept higher.

The only quiet winner? Gold—just sat there like a champ and closed basically flat in the middle of all that chaos.

Tomorrow we’ve got the biggest November options expiration ever—$3.1 trillion notional. Translation: seatbelts might still be required.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Nvidia absolutely crushed earnings last night—beat on top, beat on bottom, guidance through the roof—and the market threw a massive party at the open.

Everything was flying… for about an hour. Then the rug got yanked. Classic pump-and-dump chaos took over, and by the close the major indexes got absolutely spanked. What started as “AI is unstoppable” ended as “take profits and run.”

Our TTIs didn’t escape the carnage. The domestic one took the hardest punch, while the international TTI held up a bit better.

That said, both pulled back but—importantly—still closed above their long-term trend lines, so they’re hanging onto “Buy” mode for now.

This is how we closed 11/20/2025:

Domestic TTI: +1.54% above its M/A (prior close +2.80%)—Buy signal effective 5/20/25.

International TTI: +6.96% above its M/A (prior close +7.47%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli