ETF Tracker StatSheet

You can view the latest version here.

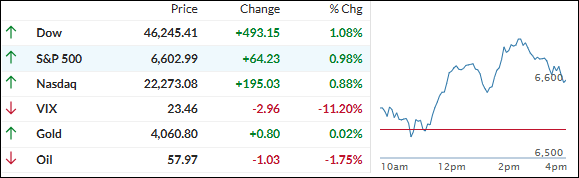

FROM BLEEDING RED TO FRIDAY GREEN – FED DOVES SAVE THE DAY

- Moving the market

Early on, things looked ugly—S&P and Nasdaq were still bleeding from Thursday’s epic Nvidia pump-and-dump, and the AI-valuation hangover was real.

Then Fed Governor John Williams (and a few other dove-ish voices) stepped up with some “we’re still cutting” vibes. Boom—December cut odds shot from 39% to over 70% in hours, and that was the spark the bulls needed.

Mid-session the mood flipped, buyers piled in, and we clawed our way from red to a solid green close. Nice little chunk of Thursday’s losses erased in one swoop.

Still, let’s keep it real: mega-cap tech just wrapped its third straight losing week, the most-shorted stocks bounced Friday but are still deep in the red for the week, and bitcoin got absolutely wrecked again—dipping to levels we haven’t seen since April before limping back toward $85K.

Liquidity’s tight, leveraged players are getting margin-called left and right, and it shows.

The quiet hero? Gold. Never flinched, closed the week comfortably above $4,000 after kissing $4,100 intraday. Right now, physical gold is straight-up embarrassing its digital cousin.

Bottom line: one good day doesn’t erase the bruises, but dovish Fed chatter gave the market exactly the lifeline it wanted.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The day started sleepy, almost like everyone was still shaking off yesterday’s hangover.

But once the buyers showed up, they didn’t mess around—bullish vibes took over and never let go. We got a full-session grind higher with nice steady gains all the way to the close.

The major indexes all finished solidly green. That said, the week still ended in the red—today was just a big, beautiful Band-Aid.

Best part? This bounce wasn’t another “Mag 7 to the rescue” story. It was genuinely broad—small caps, cyclicals, financials, you name it—so the internals looked healthy for once.

That gave our TTIs a sweet lift, especially the domestic one, which had a standout day.

This is how we closed 11/21/2025:

Domestic TTI: +3.41% above its M/A (prior close +1.54%)—Buy signal effective 5/20/25.

International TTI: +7.21% above its M/A (prior close +6.96%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli