- Moving the market

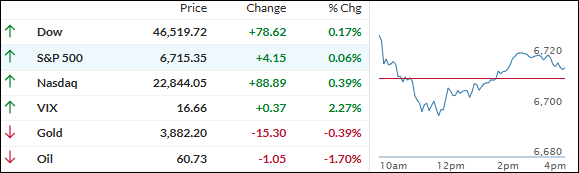

It was another quiet start for the markets, with traders mostly brushing off worries about the U.S. government shutdown, now in its second day.

The Nasdaq nudged up 0.39%, hitting a fresh intraday high thanks to Nvidia, which continues to attract heavy investment and reached its own record high.

Yesterday’s gains across the major indexes were fueled by optimism that the funding lapse won’t last long or do much damage to the economy. Historically, these shutdowns haven’t had a major impact on equity performance, and so far, this one seems to be following that pattern.

Still, the big question is: how long will this political standoff drag on? With the Senate taking Thursday off for Yom Kippur, the earliest next vote could be Friday. Prediction markets are leaning toward a shutdown that could stretch close to two weeks.

Despite the drama in Washington, the indexes managed to end the day in the green again. Even the most shorted stocks got a lift.

Tesla, however, took a 5% hit after an early rally fizzled out. The “Magnificent Seven” tech giants still outperformed the rest of the S&P 500, but only slightly.

Bond yields were mixed, and the dollar jumped for no clear reason, which put pressure on gold. The metal tried to break past $3,900 but couldn’t quite make it.

Meanwhile, Bitcoin surged to $121,000—a level not seen since mid-August.

So, here’s the question: Is digital gold finally syncing back up with global liquidity again?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The market got off to a decent start, but stocks wavered around midday as traders weighed shutdown uncertainty and mixed economic signals.

Late in the session, buyers returned and boosted all the major indexes to a positive close, with the Nasdaq leading the charge thanks to strong gains in tech and AI names.

Our TTIs followed suit and ended the day higher, matching the broader rebound.

This is how we closed 10/02/2025:

Domestic TTI: +7.46% above its M/A (prior close +7.21%)—Buy signal effective 5/20/25.

International TTI: +11.94% above its M/A (prior close +11.71%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli